The insurance industry is undergoing rapid transformation, driven by advancements in claims process automation. The adoption of AI has significantly improved the efficiency and accuracy of claims processing, enabling insurers to manage high volumes of claims quickly while reducing the risk of fraud. With the integration of AI, traditional claims management processes that once took days or weeks can now be resolved within minutes, delivering faster resolutions and improved customer experiences.

In this article, we’ll explore the role of AI in automated claims management, focusing on how it enhances claims processing, reduces manual errors, and transforms the future of insurance claims handling.

What is Claims Process Automation?

Claims process automation refers to the use of technology, particularly AI and machine learning, to automate various steps in the insurance claims lifecycle. From data entry and document verification to fraud detection and final settlement, automation reduces the need for manual intervention at every stage.

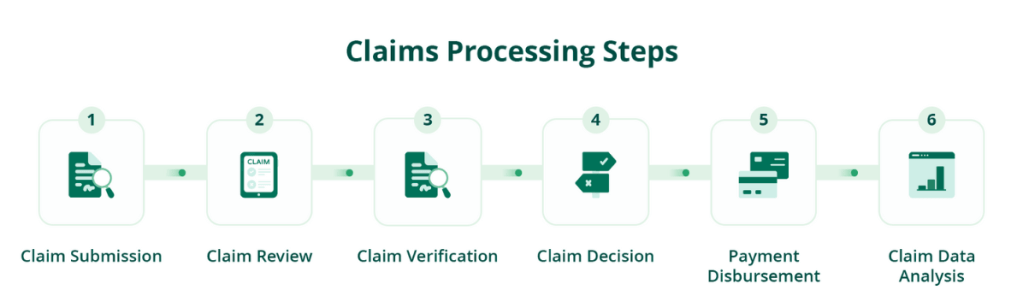

Key Steps in the Claims Process:

- Claims Submission: Policyholders submit claims via various channels, including web portals, mobile apps, or call centers.

- Data Capture and Verification: AI tools extract data from submitted documents, verify the information, and cross-check it with existing policies.

- Claims Assessment: AI-driven models analyze the claim details, predict potential risks, and assess the legitimacy of the claim.

- Fraud Detection: Automated systems flag suspicious claims for further review, ensuring accurate payouts.

- Final Settlement: Once verified, the system processes the claim and approves the payout to the policyholder.

Benefits of AI in Claims Process Automation

AI is revolutionizing how insurers handle claims by automating repetitive tasks and leveraging predictive analytics. Here’s how AI claims processing adds value to the claims management system.

1. Faster Claims Resolution

Automation accelerates the entire claims process, enabling insurers to process claims in real-time. By automatically verifying data and matching claims to policies, AI drastically reduces processing times, allowing claims to be resolved faster than ever before.

2. Enhanced Accuracy and Reduced Errors

Manual claims handling is prone to human errors, such as incorrect data entry or overlooked documentation. With AI claims processing, data extraction and verification are automated, significantly reducing the chance of errors. This leads to more accurate claims assessment and fewer disputes.

3. Improved Fraud Detection

AI tools use pattern recognition and predictive analytics to detect fraudulent claims. By analyzing large datasets and identifying unusual patterns, AI can flag potentially fraudulent claims for further investigation, reducing the financial impact of insurance fraud.

4. Cost Efficiency

Automation eliminates many of the manual tasks involved in claims processing, reducing labor costs. Additionally, with faster claims processing, insurers can avoid costly delays and improve overall operational efficiency, leading to significant cost savings.

5. Enhanced Customer Experience

A streamlined claims process results in quicker responses and faster payouts for policyholders, leading to improved customer satisfaction. Automation allows insurers to handle large volumes of claims without compromising on service quality, creating a positive customer experience.

AI-Powered Claims Processing: How It Works

AI plays a central role in automated claims management by using machine learning algorithms, natural language processing (NLP), and data analytics to enhance the speed and accuracy of claims processing.

1. Automated Data Extraction

AI tools, such as Optical Character Recognition (OCR) and NLP, extract and organize data from claim forms, invoices, and supporting documents. This minimizes the need for manual data entry and ensures that the correct data is captured for each claim.

2. Predictive Analytics for Risk Assessment

AI uses predictive models to analyze historical data and identify potential risks in the claims process. This enables insurers to make informed decisions and prioritize high-risk claims for manual review, while low-risk claims can be automatically processed.

3. Fraud Detection Algorithms

AI-driven fraud detection systems analyze patterns of past fraudulent claims to detect anomalies in new claims submissions. These systems can cross-reference data from multiple sources, including social media, medical reports, and previous claims, to identify inconsistencies and flag suspicious activity.

4. Claims Routing and Prioritization

AI systems automatically route claims to the appropriate department or adjuster based on complexity and urgency. By using predictive analytics, insurers can categorize claims and streamline the review process, ensuring that claims are handled by the right people at the right time.

Overcoming Challenges in AI Claims Processing

While AI claims processing offers numerous benefits, it’s important to acknowledge and address certain challenges when implementing this technology.

1. Data Quality and Integrity

AI systems rely heavily on accurate and clean data. Poor-quality data can lead to incorrect claims assessments or missed fraud detections. Insurers must ensure their databases are well-maintained and regularly updated to achieve the best results from AI systems.

2. Regulatory Compliance

With AI automating much of the claims process, insurers need to ensure that they comply with industry regulations. Data privacy and security are key concerns, especially when handling sensitive customer information. Insurers need to adopt robust data governance practices and stay up-to-date with regulatory changes.

3. Integrating AI with Legacy Systems

Many insurers use legacy systems that may not be compatible with modern AI technologies. To fully leverage the benefits of AI, companies must invest in upgrading their infrastructure or finding AI solutions that integrate seamlessly with their existing systems.

4. Human Oversight

While automation can handle many aspects of claims processing, human oversight remains crucial, especially for complex claims or those flagged as potentially fraudulent. Keeping a human in the loop ensures that AI recommendations are thoroughly reviewed and that final decisions are fair and accurate.

How Kudra Enhances Claims Process Automation

Kudra.ai offers a powerful AI-driven solution for claims process automation, helping insurers streamline their operations and improve accuracy. With Kudra.ai, insurance companies can reduce manual workloads, detect fraud more effectively, and provide faster claims resolutions, all while maintaining compliance with regulatory standards.

Key Features of Kudra’s Claims Automation:

• AI-Powered Claims Triage: Automatically categorizes and routes claims based on complexity and urgency.

• Fraud Detection: Identifies suspicious claims using advanced analytics and real-time data analysis.

• Customizable Workflow Automation: Tailors the claims process to fit specific business needs, from claims intake to final settlement.

By adopting Kudra, insurers can enhance their claims process automation and deliver superior service to their policyholders. For document automation, learn about AI extraction from insurance documents to drive efficiency

The Future of Claims Process Automation

As AI continues to evolve, its impact on claims process automation will only grow stronger. By adopting automated claims management and leveraging the power of AI, insurers can increase efficiency, reduce costs, and improve customer satisfaction. The future of insurance lies in automation, and businesses that embrace this change will be well-positioned for success.