Financial statements – balance sheets, income statements, cash flow statements – contain a wealth of data that can reveal much about a company’s financial health and performance when interpreted correctly. However, making sense of the numbers and ratios can be an arduous task even for seasoned finance professionals and accountants. For students who are new to accounting and corporate finance, interpreting financial statements can seem especially daunting.

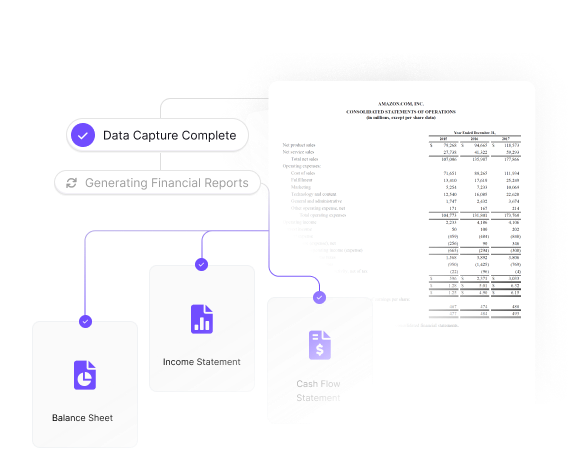

This is where Kudra’s revolutionary AI-powered intelligent document processing solution comes in. With advanced optical character recognition, natural language processing capabilities, and integration with other cognitive services like ChatGPT, Kudra can extract and analyze data from financial statements with ease and automate many of the complex analytical tasks involved. Let’s explore how Kudra is transforming financial statement interpretation.

The Significance of Financial Statement Analysis

Financial statement analysis is crucial for evaluating a company’s profitability, liquidity, financial stability, and attractiveness to investors over time. It involves calculating and interpreting critical ratios and metrics that shed light on the company’s financial health.

Key categories of ratios derived from financial statements include:

– Profitability ratios like gross margin, operating margin, and return on equity that measure the company’s ability to generate profits relative to revenue and assets.

– Liquidity ratios such as current and quick ratios gauge a company’s capacity to pay off short-term liabilities.

– Leverage ratios including debt-to-equity ratios that assess financial leverage and long-term solvency.

– Valuation ratios like price-to-earnings and price-to-book ratios that determine share price valuation and investors’ perceptions of the company’s prospects.

While financial ratios offer vital insights, most accounting and finance students struggle with their application during financial statement analysis. Manual number crunching and calculations make the process cumbersome and prone to errors. Students also often lack the contextual knowledge to accurately interpret what the ratios imply about the company’s financial position.

This is where Kudra comes in to revolutionize how students and professionals approach financial statement interpretation.

Overcoming Weaknesses of Traditional Financial Statement Analysis

Financial statement analysis has conventionally been an intensive, manual process with several pain points:

– Tedious extraction of numbers from statements to calculate ratios is time-consuming and repetitive

– Formulas for some ratios can be complex for students new to accounting and finance

– Contextual and qualitative interpretation of ratios poses a challenge without experience

– Lack of big-picture analysis on how ratios correlate to paint an overall picture of financial health

– Difficulty tracking financial performance over reporting periods and projecting future profitability

Kudra sidesteps all these issues through automated data extraction and intelligent analytical capabilities; It has completely revolutionized Automated financial reporting in 2024 along with many aspects of financial data extraction.

Kudra’s AI Transforming Financial Statements Interpretation

Kudra possesses optical character recognition (OCR) and natural language processing (NLP) capabilities that can instantly extract numeric data and narratives from scanned or digital financial statements in all formats – PDF, Word, Excel etc.

Kudra’s workflows can then process this extracted data, perform any complex ratio calculations fully automatically and analyze what the ratios indicate about profitability, liquidity, leverage etc. over time.

For example, Kudra’s profitability analysis workflow can:

– Extract revenue, cost of goods sold, operating expenses numbers from income statements

– Calculate gross margin, operating margin and net profit margin ratios year-over-year

– Analyze if and why profitability is decreasing/increasing based on trends over reporting periods

– Identify any specific items or activities impacting profitability metrics

This level of automated data extraction and analysis would take hours for students to complete manually. Kudra gets it done in minutes with 100% accuracy.

That’s not all. Kudra’s AI can also intelligently correlate different ratios to assess the overall financial position from multiple angles.

For instance, declining liquidity ratios along with surging leverage ratios can signal future insolvency risks. Kudra can flag such correlations and adjust projections and valuations accordingly. Its dynamic analytical capabilities go far beyond static ratio calculations.

Kudra’s seamless ChatGPT integration powers natural language queries allowing users to simply ask:

“What is this company’s projected profitability over the next two quarters based on current ratio analysis?”

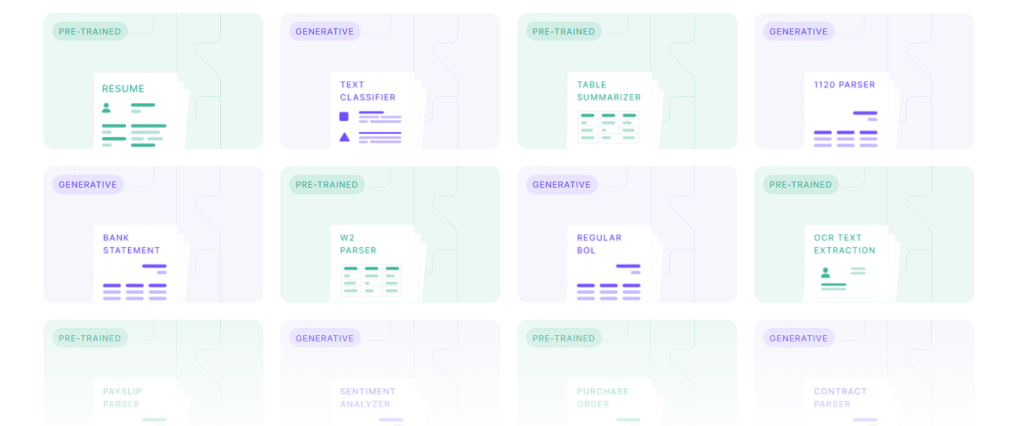

They can also leverage Kudra’s AI to train custom models. With just 20 labeled examples, Kudra can build models that outperform out-of-the-box algorithms tuned to specifics of the financial analysis use case – accounts, disclosures, terminology etc.

Advantages over Conventional Financial Statements Analysis

Kudra maximizes efficiency, minimizes errors, and enhances analytical insights for financial statement interpretation in ways conventional manual methods cannot match:

1. Pre-configured templates for all common financial documents eliminate time wasted on data extraction

2. Automated workflows perform complex ratio calculations with 100% precision

3. Interactive dashboards present key ratio trends in easily consumable visual format

4. Integration with NLP and ChatGPT facilitates both simple and complex natural language queries on financial performance

5. Advanced analytics deliver dynamic correlations between ratios and projections based on historical trends

6. Custom AI models provide analysis fine-tuned to company and industry-specific nuances

With Kudra, financial statement interpretation becomes faster, smarter, and more comprehensive. Time saved from manual tasks can be better utilized to strategize and project future profitability.

Conclusion

Financial statements hold valuable clues about a company’s financial position and profitability. But unlocking these clues can prove challenging for accountants, let alone students new to accounting. Kudra’s AI-based automation of data extraction, ratio analysis and natural language queries helps overcome traditional pain points. By enhancing analytical capabilities beyond conventional methods, Kudra delivers efficiency, precision and deeper financial insights necessary to interpret statements accurately. Its 21st century technological capabilities provide the perfect tool to help both aspiring and seasoned finance professionals master the intricacies of financial reporting. As AI continues to transform businesses, platforms like Kudra will revolutionize areas like financial analysis to drive better decision making.