Insurance claims processing is a complex, document-intensive process. As policies and claims continue to grow in volume and complexity, manual claims processing is becoming increasingly cumbersome. This outdated approach is rife with inefficiency, inflated operational costs, data errors, and fraud risks.

Insurance providers globally handle vast volumes of unstructured data locked away in documents like claim forms, bills, medical records, police reports, etc. Making sense of this data through manual processing takes up countless hours of human effort riddled with human error. An average claims processor spends 50-70% of their day performing repetitive manual tasks like validating forms, extracting information, cross-checking facts between documents instead of focusing on value-added activities.

As per leading industry reports, nearly 30% of data entry could contain errors. Another study by Celent estimates that the cost of processing a single auto insurance claim can range from $300-500. For health insurance claims, it can be as high as $800-1500 per claim. The numbers speak for themselves – manual claims processing is a significant cost and productivity sinkhole.

What is Claims Processing Automation?

Claims Processing Automation refers to the use of intelligent technologies like AI, Machine Learning, Robotic Process Automation (RPA), Intelligent Document Processing (IDP), and Chatbots to digitize and streamline the claims management process.

It aims to simplify the extraction of relevant information from documents, speed up claims assessment, improve accuracy, lower costs, and deliver superior customer experience.

Some key technologies playing a stellar role in automating the claims process include:

• Intelligent Document Processing (IDP): IDP utilizes AI and machine learning algorithms to automatically classify, extract, validate, and process both structured and unstructured data from documents with little to no human intervention. IDP tools can read and capture data from claim forms, bills, medical records, repair estimates, police reports, etc. in any format with incredible accuracy.

• Robotic Process Automation (RPA): RPA allows configuring “software robots” to automate repetitive, rule-based tasks at scale. In claims processing, RPA bots can obtain documents, extract data, update systems, and route claims automatically allowing agents to handle more complex exceptions.

• Intelligent Automation (IA): A combination of AI and RPA, Intelligent Automation aims to transform end-to-end processes like first notice of loss, claims registration, adjudication, settlement, and closure. It focuses on mimicking human-like judgment and complex decision-making to process claims faster.

• Chatbots/Virtual Assistants: Chatbots allow swift self-service by answering policyholders’ common claims-related queries. They offer 24×7 assistance guiding customers through the claims process providing updates on the status and documents needed. This improves experience and frees up agents’ time.

Kudra's Intelligent Document Processing Solution for Claims Proceesing

Kudra is an AI software company providing an Intelligent Document Processing platform purpose-built for the insurance industry. Their cutting-edge cognitive automation solution turns unstructured data into structured actionable insights within the existing IT infrastructure.

It combines AI, machine learning, and Robotic Process Automation in a simple low-code/no-code environment. With Kudra, insurers can easily build smart automation workflows with electronic data extraction, classification, validation, and integration capabilities.

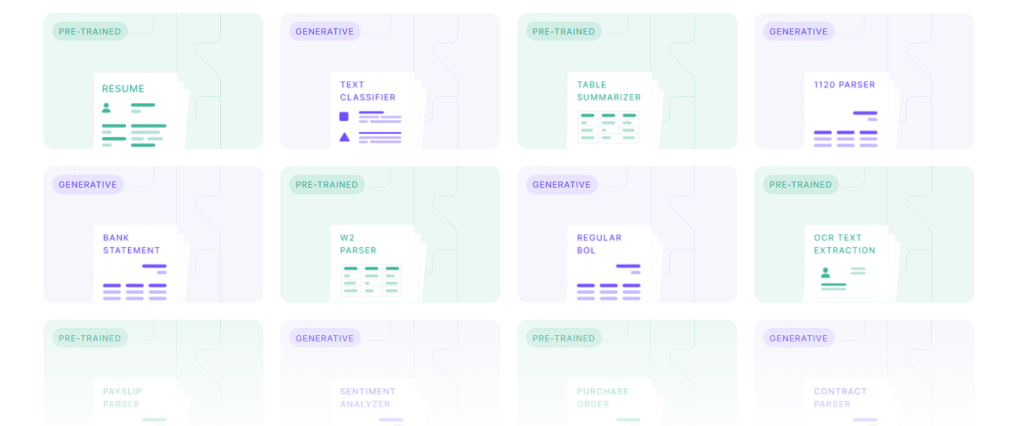

It delivers ready-to-use AI models trained on millions of insurance documents that can be customized for specific use cases. The easy-to-use drag and drop interface allows claims handlers to rapidly create document centric business processes minus any coding.

Kudra provides pre-built AI extraction templates for faster automation of high-volume document types like medical bills, explanation of benefits (EOBs), estimates, appraisals, police reports etc. Users can also leverage Kudra’s advanced NLP engine and intuitive workflow builder to train AI models to extract information from complex custom documents.

The integrated ChatGPT assistant allows human-like interactions to assist agents, answer questions, and provide recommendations drawing insights from processed documents. This amplifies efficiency allowing staff to focus on critical thinking tasks.

Benefits of Automated Claims Processing with Kudra

• Streamlined Data Extraction: Kudra can intelligently extract unstructured data locked in claim documents like policy numbers, claim details, dates, repair estimates, medical codes at an accuracy of over 99%. This structured data seamlessly flows into guidelines analysis, fraud detection, subrogation, etc. improving decision-making.

• Enhanced Productivity: Kudra bots handle repetitive tasks like data entry, forms processing, and document comparison freeing up over 70% of agents’ workload. This allows resources to be reallocated to value-added activities like claims investigation, litigation support, and enhanced customer service.

• Reduced Operational Costs: Automating the document and data-centric elements of claims processing delivers over 60% efficiency gains. This significantly brings down reliance on manual effort and claims processing costs.

• Superior Accuracy: AI models trained on millions of documents can extract information, validate facts, and detect discrepancies better than humans reducing processing errors by nearly 30%. This improves claims assessment and resolution.

• Fraud Reduction: Kudra provides advanced anomaly detection, pattern recognition, and predictive analytics to identify fraudulent claims, statements, bills, etc. early on. This minimizes losses allowing investigators to focus on high-risk claims.

• Faster Claims Processing: Automating repetitive tasks reduces cycle times allowing valid clean claims to be registered, validated, and paid out faster. The integrated smart workflow prioritization, parallel processing and straight-through processing minimizes delays.

• Enhanced Customer Experience: Quicker cycle times, prompt responses improved by AI-powered chatbots and better communication through process transparency delivers superior customer experience.

• Centralized Data & Documents: All data and documents are digitized and accessible on a single platform providing stakeholders a 360-degree view of the claim status. This aids in better collaboration and decision-making.

• Regulatory Compliance: Kudra allows the creation of rules to validate claims against compliance guidelines. It also provides audit trails improving governance, reporting, and analytics.

Implementing Successful Claims Process Automation with Kudra

Like any digital transformation initiative, automating claims processing requires strategic planning, executive buy-in, well-defined goals, and a customer-centric design.

Here are some best practices to ensure a smooth implementation:

– Phase-Wise Approach: Complex processes like claims span people, procedures, and systems. It’s pragmatic to start with high-volume transactional processes, achieve ROI, and then scale across operations.

– Collaboration & Communication: Business and IT teams should collaborate to balance automation with human oversight. Continual communication on process changes and training end-users minimizes disruption during transition.

– Design Optimal Workflows: The workflow design should focus on enabling straight-through processing maximizing auto-adjudication rates minimizing manual intervention.

– Iterative Improvement: Leverage process mining, and analytics for continuous feedback to tweak workflows, AI models, etc. to achieve efficiency gains, cost savings, and superior customer experience.

– Leverage AI Assistance: Kudra’s integrated ChatGPT-based human-like assistant can be leveraged to answer queries, and provide recommendations to augment staff productivity.

Kudra’s team of experts helps insurers craft an automation roadmap aligned to business goals. Their Center of Excellence offers best practices and continues to train AI models using client data to deliver maximum ROI. With in-built process orchestration and analytics, Kudra gives insurers unmatched visibility into operational performance.

Conclusion

As insurance customers demand superior, transparent, and real-time experience, manual claims processing is proving inadequate. Intelligent Process Automation is pivotal for insurers seeking accelerated growth and market leadership.

Kudra, with its purpose-built IDP platform, insurance-trained AI models, rapid workflow configuration capabilities and process orchestration tools can transform claims processing. Insurers can leverage Kudra to boost straight-through processing rates, productivity, and speed of services and deliver the next-gen experience – all while optimizing costs.

By harnessing intelligent document processing, insurers will be able to scale operations, pursue new markets, and acquire customers profitably. The future lies in embedding “intelligence” into processes. It’s time for insurers to onboard this revolution and pave the way for the next level of efficiency and innovation!