Artificial Intelligence (AI) is transforming the world of financial analysis. From analyzing trends to helping you extract data from financial statements, AI financial data extraction has revolutionized how businesses handle financial statements. AI’s impact goes beyond simple automation—it offers deeper insights, faster results, and higher accuracy.

Why Extract Data from Financial Statements?

Financial statements—balance sheets, income statements, and cash flow statements—provide a snapshot of a company’s financial health. For businesses, extracting data from financial statements allows them to:

- Evaluate performance metrics.

- Identify trends and potential risks.

- Make data-driven strategic decisions.

However, manually extracting financial data is both time-consuming and error-prone. AI-driven solutions address these challenges by automating the process, speeding up analysis, and reducing human error.

The Emergence of AI Financial Data Extraction

AI financial data extraction uses machine learning algorithms and Optical Character Recognition (OCR) to automatically process financial statements. Platforms like Kudra lead the charge in developing AI tools that:

- Rapidly extract relevant financial data.

- Eliminate manual entry errors.

- Provide structured and analyzable data for financial forecasting and reporting.

This transformation enhances productivity by allowing businesses to focus on insights rather than manual data input.

Why Use AI to Extract Data from Financial Statements?

1. Time-Saving: AI dramatically reduces the time it takes to process financial data. What used to take days or weeks can now be completed in hours.

2. Improved Accuracy: Manual data extraction is vulnerable to human error, which can lead to significant financial reporting discrepancies. AI ensures consistent and accurate data extraction.

3. Scalability: Businesses can handle growing volumes of financial statements without increasing their workforce. AI systems can process thousands of documents, ensuring that scalability does not come at the cost of quality.

4. Real-Time Insights: AI-powered solutions like Kudra allow businesses to extract and analyze data in real time, providing actionable insights that help them stay competitive.

5. Cost-Efficiency: Automating the data extraction process can lead to significant cost savings, especially in labor and operational expenses.

How to Use AI to Extract Data from Financial Statements?

The AI-driven financial data extraction process is straightforward and consists of several steps:

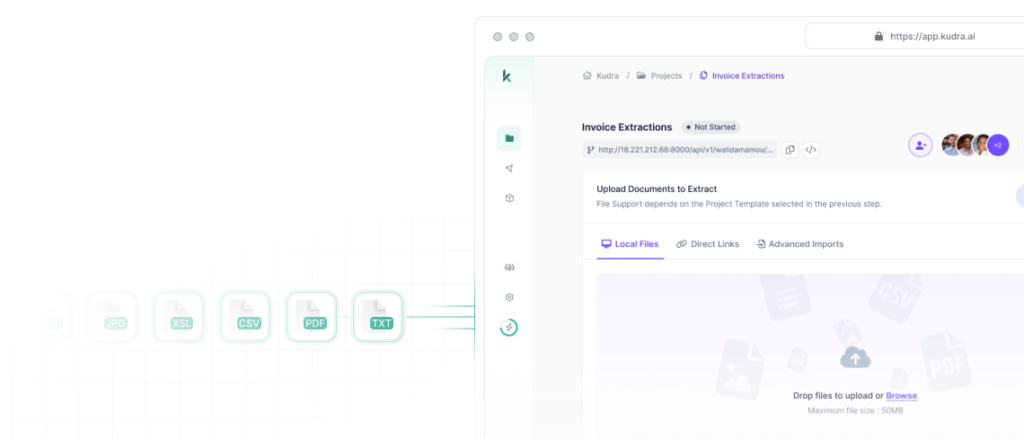

1. Document Input: Financial documents, including PDFs, spreadsheets, and scanned files, are uploaded into an AI tool.

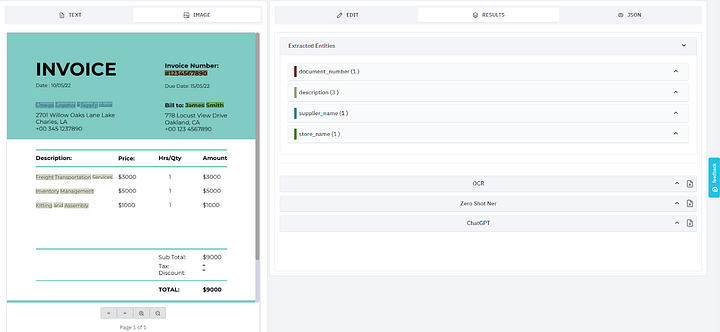

2. Data Identification: AI uses OCR and natural language processing (NLP) to identify text and numeric data from financial statements.

3. Data Extraction: Once identified, the relevant financial metrics (e.g., revenue, expenses, assets) are extracted and categorized.

4. Data Structuring: AI systems structure the extracted data in an easily analyzable format. This allows for faster financial reporting and deeper analysis.

5. Integration: Extracted data can be seamlessly integrated into financial software or ERP systems for immediate use in reports and forecasts.

Automating Financial Statement Analysis

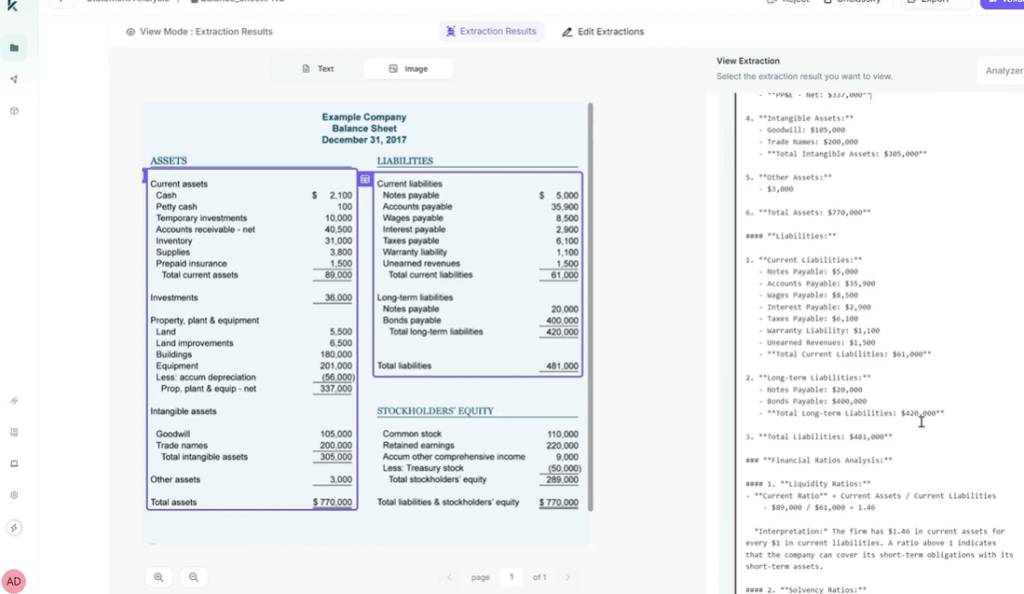

Automating financial statement analysis allows businesses to dive deeper into their financial data without manual intervention. AI-driven financial statement analysis automation processes financial documents, identifies key metrics, and provides comprehensive reports that assist in making well-informed financial decisions.

Platforms like Kudra allow for:

- Real-time tracking of KPIs.

- Automatic ratio calculations (liquidity, profitability, and solvency).

- Customized dashboards that highlight essential financial data.

Challenges and Solutions in AI Financial Data Extraction

- Data Quality: Poorly scanned documents or inconsistent formatting can pose challenges for AI. However, advanced OCR and machine learning models are constantly improving their ability to process even low-quality documents.

- Integration with Existing Systems: Businesses may face integration challenges when implementing AI solutions. Kudra addresses this by offering seamless integration with a wide range of financial software and ERP systems.

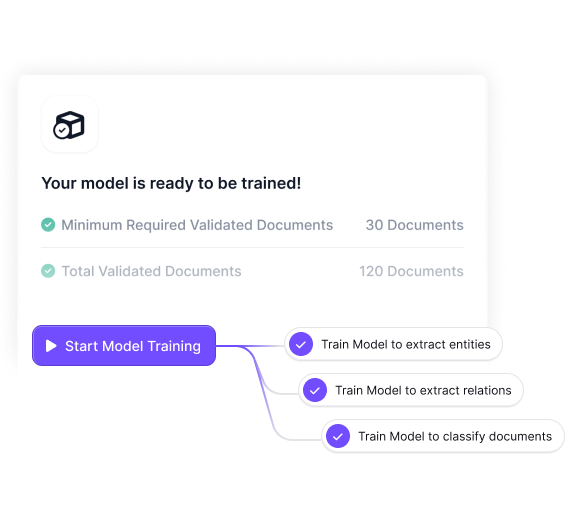

- Training AI Models: AI models require large datasets to train and refine their algorithms. Kudra’s use of machine learning ensures that its systems get better over time, improving accuracy with every document processed.

Kudra: Changing the Way You Extract Data from Financial Statements

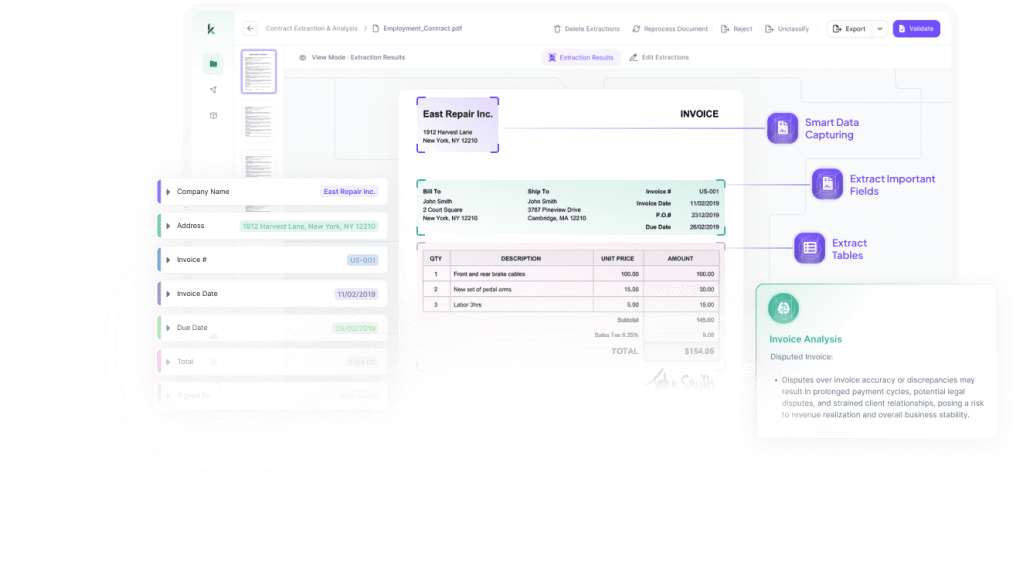

Kudra is at the forefront of AI-driven financial data extraction and analysis automation. With Kudra, businesses can:

• Automate the extraction of financial data from statements.

• Generate real-time insights that improve decision-making.

• Seamlessly integrate financial data into existing ERP and accounting systems.

Whether you’re a financial professional or a business owner, Kudra offers tailored solutions that transform how you handle financial data, improving both accuracy and efficiency.

Conclusion: The Future of Financial Analysis is AI

The future of financial analysis lies in AI. By automating the extraction of data from financial statements, AI not only reduces manual errors but also improves the speed and depth of financial insights. Solutions like Kudra offer businesses the tools they need to stay competitive in an increasingly data-driven world.

If you want to transform your financial processes, consider implementing AI financial data extraction to unlock unparalleled insights and efficiencies.