Financial analysts and credit managers dread the tedious task of spreading financial statements. Manually transferring data from PDF reports onto Excel templates is mundane yet critical work. Even minor transcription errors can lead to faulty analysis and poor lending decisions.

Fortunately, artificial intelligence now empowers businesses to automate financial spreading. Technologies like optical character recognition (OCR) and intelligent document processing can extract data from statements and populate spreadsheets instantly. This not only eliminates drudgery but also boosts productivity and risk management capabilities.

Let’s explore the transformative potential of automating financial spreading. We’ll highlight innovative solutions like Kudra that leverage AI to liberate finance teams from repetitive manual work.

The Vital Role of Financial Statement Spreading

Before diving into automation, it’s crucial to know the answer to this question: What is the Importance of Spreading Financial Statements ? The term refers to the practice of reformatting statements into a standardized layout that enables easier analysis.

For instance, an analyst may make an annual report in PDF form and transfer specific line items like assets, liabilities, and cash flows into a formatted Excel template. The standardized spreadsheet makes it simpler to calculate financial ratios, analyze trends over reporting periods, and compare performance across companies.

Financial spreading plays a crucial role in areas like:

• Credit Analysis: Lenders depend on accurate financial analysis to make prudent loan underwriting decisions and minimize default risk exposure. Spreading statements facilitates ratio analysis, credit modeling, peer benchmarking, and more to assess borrower creditworthiness.

• Financial Planning and Analysis (FP&A): FP&A teams develop budgets, forecasts, and performance reports relying on historical operating metrics. Spreading past statements enables insightful modeling, scenario planning, variance analysis, and more.

• Investment Analysis: Equity and credit analysts gather intelligence to determine fair asset valuations and investment decisions. Spreading financials is critical for modeling discounted cash flows, conducting ratio analysis, identifying growth drivers, and assessing investment risks.

In summary, financial spreading powers critical organizational decisions related to lending, valuations, budgeting, performance management, and more. Yet despite its importance, spreading statements manually consumes massive analyst time and leaves room for error.

OCR Technology: Extracting Data from Financial Statements

Optical character recognition or OCR makes it possible for computers to identify text, numbers, and symbols within document images. Advanced OCR engines use machine learning and pattern recognition to translate scanned reports into machine-readable, editable, and searchable formats.

In finance, OCR empowers the automated extraction of data from statements available in non-structured formats like PDF and static image files. Specific OCR capabilities like:

– Text recognition – Identifies and extracts printed alphanumeric characters

– Intelligent document classification – Categorizes documents by type

– Table recognition – Detects and processes data from tables

– Invoice recognition – Parses invoice details

– Handwriting recognition – Transcribes text and numbers written by hand

Such capabilities allow OCR software to review financial statements and systematically pull relevant data points into spreadsheets, databases, and other digital environments. This eliminates the need for manual transcription while enabling analysis-ready structured data.

For instance, an annual report PDF can be processed by OCR algorithms to identify key items across financial statements. Revenues, expenses, assets, liabilities, and other metrics get extracted into Excel automatically without human effort.

The technology minimizes manual errors, saves massive analyst time, and enables quick analysis based on up-to-date financial figures. Next, let’s review how Kudra’s intelligent document processing solution empowers the automation of financial spreading activities.

Kudra’s Financial Statement Spreading Solution

Kudra provides an artificial intelligence platform purpose-built to analyze all kinds of documents – from contracts and invoices to financial statements and logistics records. The company’s intelligent document processing solution combines OCR capabilities with an intuitive workflow builder, pre-trained AI assistants, and integrated third-party apps.

In terms of inputs, Kudra can ingest statements in virtually any format – including scanned paper documents, images, PDF files, Word/Excel downloads, CSV exports, and more. The platform’s advanced OCR engines quickly render these files into structured datasets without manual intervention.

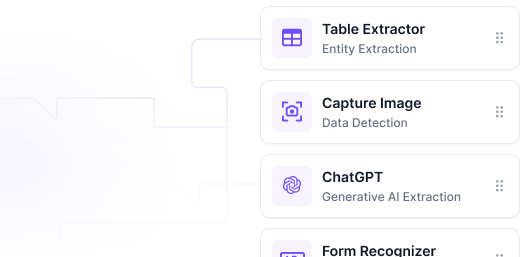

Kudra makes it easy for non-technical users to set up automated workflows tailored to their specific reporting needs. The self-service workflow builder provides a user-friendly drag-and-drop interface to:

– Classify incoming documents by type

– Apply OCR to extract text, tables, and other data

– Route information to desired storage platforms like Dropbox or QuickBooks

– Enrich data using Kudra’s built-in ChatGPT module

– Train custom AI models to handle unique document objects

The flexibility to string together different steps enables tailored financial spreading routines. For instance, a credit lending workflow may:

1. Use OCR to convert annual report PDFs into Excel

2. Classify statements into standard categories like balance sheets, income statements, etc.

3. Identify and extract key metrics from each statement type

4. Load figures into a formatted analysis template

5. Calculate ratios and financial indicators

Such automated workflows run around the clock without human oversight, ensuring the latest financials are always available for review. Kudra’s integrated ChatGPT assistant provides additional intelligence to handle use cases like identifying non-standard line items, querying figures, or generating statement summaries.

The platform also offers 20+ pre-built AI assistants covering financial documents like loan applications, tax forms, payroll records, bank statements, and more. Users can leverage these readymade templates as shortcuts for common spreading tasks.

With Kudra’s AI-powered automation, organizations can eliminate the manual drudgery of financial spreading. Analysts are freed from routine transcription while business leaders gain access to up-to-date, analysis-ready financials. Next, let’s review the diverse applications of Kudra’s automation capabilities.

Expanding the Applications of Financial Automation

While financial statement spreading is an ideal first application, Kudra’s document digitization platform has expansive potential across domains.

The company’s pre-trained AI catalog covers critical business functions like:

Finance – Bank statements, wire transfers, loan documents, tax forms

Legal – Contracts, legal briefs, trademark filings

Insurance – Claims processing, underwriting, actuarial analysis

Logistics – Bills of lading, customs forms, shipping manifests

Healthcare – Patient records, medical histories, test reports

Human Resources – Pay stubs, employment contracts, I9 verifications

Real Estate – Lease agreements, property deeds, appraisals

In addition, Kudra empowers users to train custom AI models tailored to their unique reporting requirements.

Conclusion: Let AI Take the Drudgery Out of Financial Statement Spreading

In closing, financial statement spreading is imperative for business insights yet mired in tedious manual effort. Modern AI solutions like Kudra promise to eliminate drudgery through automated data extraction and document digitization.

OCR gives computers the ability to ingest tables, text, and graphics within financial statements to pull structured data. When combined with an intuitive workflow automation platform, this can entirely transform financial spreading.

Teams can set up routines to ingest PDFs, images, and printed reports to instantly populate integrated spreadsheets, databases, and business intelligence tools. This enables rapid analysis, sharp decision-making, and continuous performance monitoring fueled by up-to-date data.

While finance is an ideal starting point, intelligent document processing can extend across the enterprise. Kudra offers tailored AI assistants purpose-built for logistics, legal, healthcare, human resources, and other document-intensive domains. This provides a unified automation fabric across disparate business functions.

Technologies like Kudra provide a pivotal opportunity to drive productivity, minimize errors, and unlock business insights through AI-powered document digitization. The time for solutions like intelligent financial spreading is now. Let the machines take the drudgery out of critical organizational tasks so leaders can focus on high-value analysis and strategic decision-making. The future of work is data-driven, automated, and AI-assisted.