Creating investment reports has always been one of the most labor-intensive activities in the financial industry. Investment professionals spend countless hours gathering data from multiple sources, analyzing market trends, researching company fundamentals, and crafting comprehensive reports that meet their clients’ specific needs.

The traditional approach typically involves days or even weeks of manual work. Analysts must collect financial data, review quarterly earnings reports, study market conditions, and synthesize complex information into coherent investment recommendations. Each report requires extensive research across various databases, careful fact-checking, and multiple rounds of review before it reaches clients.

This manual process creates several challenges for investment firms. First, the sheer time investment limits how many reports analysts can produce, creating bottlenecks when market conditions change rapidly. Second, the repetitive nature of data collection and formatting consumes valuable time that could be spent on higher-level strategic analysis. Third, maintaining consistency across multiple reports becomes difficult when different team members handle various aspects of the research process.

The time constraints become particularly problematic during earnings seasons or market volatility periods, when clients need timely insights to make informed decisions. Investment teams often find themselves working extended hours to meet deadlines, yet still struggle to deliver the comprehensive analysis their clients expect.

These inefficiencies have created a clear need for innovation in the investment reporting space, setting the stage for technological solutions that can transform how financial professionals create and deliver investment insights.

The Rise of AI: A Paradigm Shift in Finance

The financial industry is experiencing an unprecedented transformation. According to The 2025 AI Index Report from Stanford HAI, the proportion of survey respondents reporting AI use by their organizations jumped to 78% from 55% in 2023 – a remarkable 23 percentage point increase in just one year.

This surge reflects a fundamental shift in how financial institutions approach their operations. Organizations are moving beyond experimental AI projects to full-scale implementation across core business functions. Investment firms are now deploying AI-powered workflows that transform manual research processes into automated systems, delivering decision-ready output in minutes rather than hours or days.

The adoption pattern shows AI becoming integral to everyday financial operations. Companies are using AI agents to generate company profile slides, industry primers, and merger and acquisition analyses. These agentic AI systems can autonomously perform complex tasks without constant human intervention, representing a significant evolution from traditional rule-based automation.

Banks and investment firms are particularly aggressive adopters, implementing AI to augment employee performance, reduce technical debt, and produce tailored content at scale. The technology is reshaping everything from data analysis and report generation to cybersecurity and decision-making processes.

This rapid adoption rate signals that AI has moved from a “nice-to-have” technology to a competitive necessity in finance. Organizations that haven’t embraced AI risk falling behind as the 78% majority gains advantages in speed, accuracy, and operational efficiency.

The Promise: Expert-Level Reports in Minutes

The days of spending hours or days crafting investment reports are ending. AI technology now delivers sophisticated financial analysis in a fraction of traditional timeframes, transforming how investment professionals work.

Companies like AlphaSense demonstrate this reality with their agentic AI workflows that convert manual research into polished, decision-ready output within minutes. Their pre-built workflows handle specific tasks like company profile slides, industry primers, and M&A idea generation—all accessible through one-click automation.

McKinsey research reveals the broader impact, estimating trillions of dollars in potential economic value from generative AI. Banks specifically benefit from AI that augments employee performance and produces tailored content at scale. This isn’t theoretical—financial institutions already use AI-driven insights to reduce costs and accelerate decision-making.

The technology works through sophisticated prompt engineering techniques that investment professionals and hedge fund managers employ internally. These methods guide AI models to produce analysis that matches expert-level quality while maintaining the speed advantage.

Microsoft’s customer stories across financial services show over 1,000 implementations where AI automates report generation and enhances data analysis. The pattern emerges clearly: organizations achieve dramatic productivity gains while maintaining analytical rigor.

This transformation means investment teams can focus on strategy and decision-making rather than time-consuming report compilation. What once required teams of analysts working for days now happens in minutes, freeing professionals to concentrate on higher-value activities that drive investment success.

Understanding the AI Technologies Powering the Transformation

Machine Learning (ML): Uncovering Patterns and Insights

Machine learning forms the analytical backbone of modern AI-powered investment report generation. At its core, ML algorithms excel at identifying patterns within massive datasets that would take human analysts weeks to process manually. These systems can simultaneously analyze market trends, company financials, news sentiment, and economic indicators to extract meaningful insights.

The technology works by training algorithms on historical financial data, teaching them to recognize relationships between different variables. For example, ML models can identify correlations between earnings announcements, stock price movements, and trading volumes across thousands of companies. Once trained, these models can process new information and generate predictions or assessments within minutes.

Companies like AlphaSense demonstrate this capability through their workflow agents that transform “manual research into minutes” while delivering “polished, decision-ready output.” Their systems generate company profile slides, industry primers, and M&A analysis by applying ML algorithms to vast databases of financial information.

The pattern recognition capabilities extend beyond simple data analysis. Modern ML systems can process unstructured data like earnings call transcripts, regulatory filings, and news articles to extract sentiment and key themes. They identify subtle indicators that human analysts might miss, such as changes in management language patterns or shifts in competitive positioning.

McKinsey research highlights how banks use these AI capabilities to “produce tailored content at scale,” enabling the creation of personalized investment reports for different client segments. The ML algorithms adapt their analysis and recommendations based on specific investment criteria, risk tolerances, and portfolio objectives.

Natural Language Processing (NLP): Translating Data into Readable Reports

Natural Language Processing serves as the bridge between complex financial data and human-readable investment reports. This AI technology interprets vast amounts of market information, company filings, and economic indicators, then transforms them into clear, actionable insights that investors can understand and act upon.

The transformation happens through sophisticated algorithms that can process thousands of data points simultaneously. Where traditional report generation might take days of manual analysis, NLP-powered systems accomplish the same task in minutes. AlphaSense’s “Agentic AI Workflows” exemplify this capability, delivering “polished, decision-ready output” through automated processes that can independently plan, search, and iterate through information.

Modern NLP applications in investment reporting include generating company profile slides, industry primers, and market analysis summaries. These systems don’t just extract data—they contextualize it, identifying patterns and relationships that might escape human analysis during time-pressured situations.

The technology works by breaking down unstructured text from sources like earnings calls, regulatory filings, and news articles, then reconstructing this information into structured, readable formats. McKinsey research indicates that generative AI capabilities can produce “tailored content at scale,” meaning reports can be customized for different audiences while maintaining consistency and accuracy.

What makes NLP particularly valuable is its ability to maintain the analytical rigor of traditional research while dramatically accelerating the delivery timeline. Investment professionals can now focus on strategic decision-making rather than spending hours formatting and synthesizing data into presentable reports.

Generative AI: Automating Report Writing and Content Creation

Generative AI has become a transformative force in financial services, fundamentally changing how banks and insurance companies create content and reports. This technology goes far beyond simple text generation—it produces images, audio, video, and code that serve multiple business functions. According to the OECD, “Generative AI is transforming areas like banking and insurance by generating text, images, audio, video, and code. It is used in fraud detection, credit decisions, risk management, customer service, compliance, and portfolio management, improving accuracy and efficiency.”

The speed improvements are remarkable. What once took research teams days to compile now happens in minutes through AI-powered workflows. Companies like AlphaSense demonstrate this with their “Agentic AI Workflows” that automate tasks such as company profile creation, industry analysis, and meeting preparation materials. These systems don’t just work faster—they deliver decision-ready output that matches expert-level quality.

Banks particularly benefit from this technology’s ability to augment employee performance while reducing technical debt. McKinsey research suggests generative AI could add trillions to the global economy, with financial institutions producing tailored content at unprecedented scale. The applications span from automated compliance reports that ensure regulatory adherence to personalized customer communications that improve service delivery.

Insurance companies similarly use generative AI for risk assessment documentation, claims processing reports, and policy analysis. The technology handles complex data synthesis while maintaining accuracy standards that meet industry requirements.

Kudra’s AI-Powered Data Extraction: The Foundation for Rapid Reporting

At the heart of modern investment reporting lies a fundamental challenge: transforming vast amounts of scattered financial data into actionable insights. Traditional methods require analysts to manually gather information from multiple sources, a process that can take days or even weeks. Kudra’s AI-powered data extraction technology changes this equation entirely.

The system employs sophisticated natural language processing and machine learning algorithms to automatically identify, extract, and organize relevant financial information from diverse sources. Unlike competitors who focus primarily on end results, Kudra’s approach centers on the technical foundation that makes rapid reporting possible.

Advanced Data Processing Techniques

Kudra’s extraction engine uses multiple AI techniques working in concert. Computer vision algorithms parse complex financial documents and charts, while API integrations pull real-time market data. Natural language processing identifies key financial metrics within unstructured text, and machine learning models continuously improve accuracy based on user feedback.

From Raw Data to Decision-Ready Reports

The extraction process feeds directly into automated workflow systems that mirror how experienced analysts think and work. Rather than simply aggregating data, the AI applies financial logic to determine relevance, cross-references information for accuracy, and structures findings according to industry standards.

This technical foundation enables what competitors like AlphaSense describe as “polished, decision-ready output” delivered in minutes rather than days. The difference lies in the sophistication of the underlying extraction technology that ensures both speed and accuracy in the final investment reports.

How to Auomate Due Diligence Reports

Let’s walk through the exact process of building an automated due diligence workflow using Kudra AI. This tutorial uses investment fund due diligence as the example, but the same approach applies to vendor qualification, loan underwriting, M&A evaluation, or any other multi-document assessment process.

Interested in seeing it in action? Take a look at our step-by-step tutorial showing how the process works on our platform.

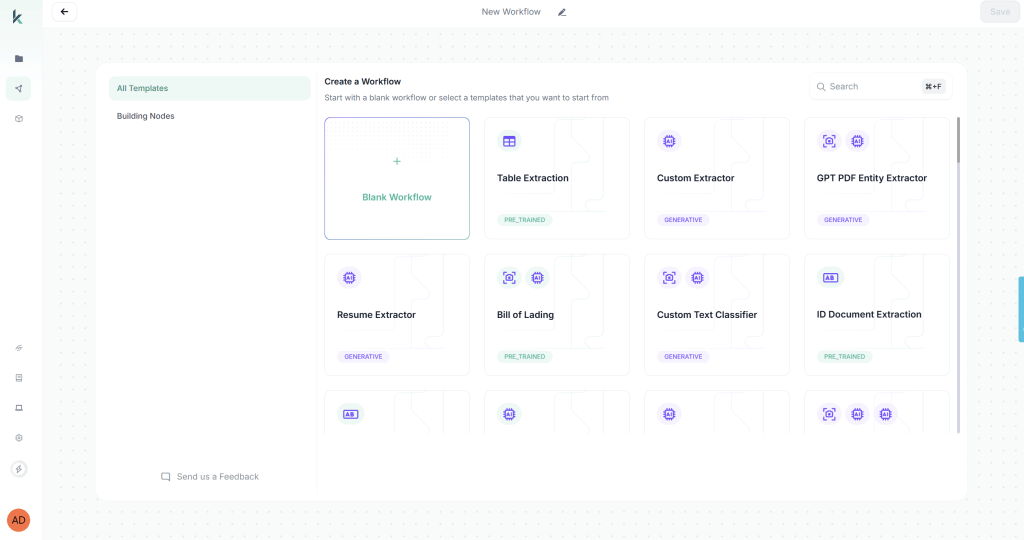

Step 1: Build the Multi-Format Document Processing Workflow

Access Kudra’s workflow builder by clicking “Create New Workflow” from the dashboard. You have two options: start from a blank workflow or use a predefined template. For this tutorial, we’ll start from scratch to demonstrate the full customization capabilities.

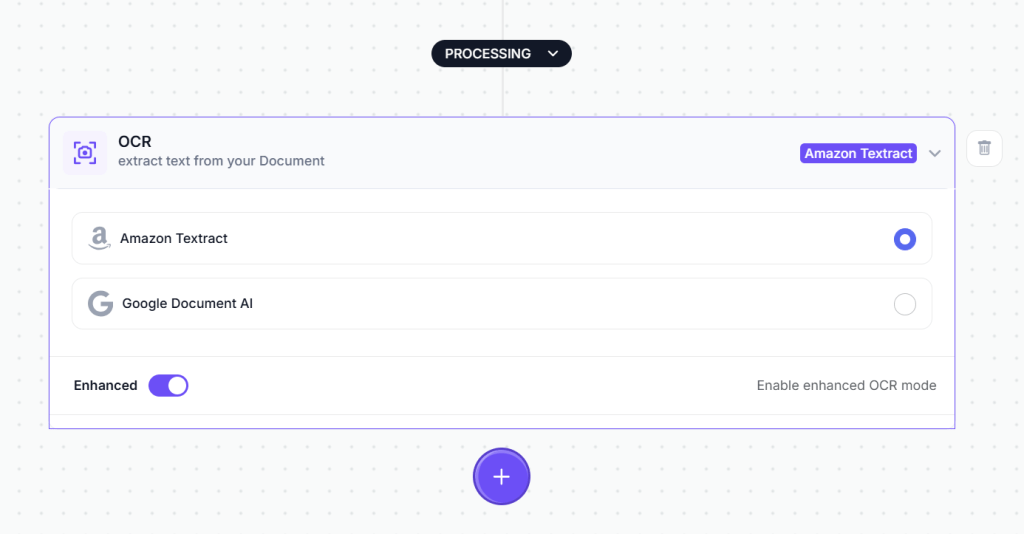

Add the OCR Component:

The first component processes the visual document and extracts raw text. From the component library, drag the OCR module onto your workflow canvas. This module handles text extraction from PDFs, scanned images, mobile photos, and any other document format you upload.

No configuration is required for the OCR component, it automatically processes whatever document format you provide.

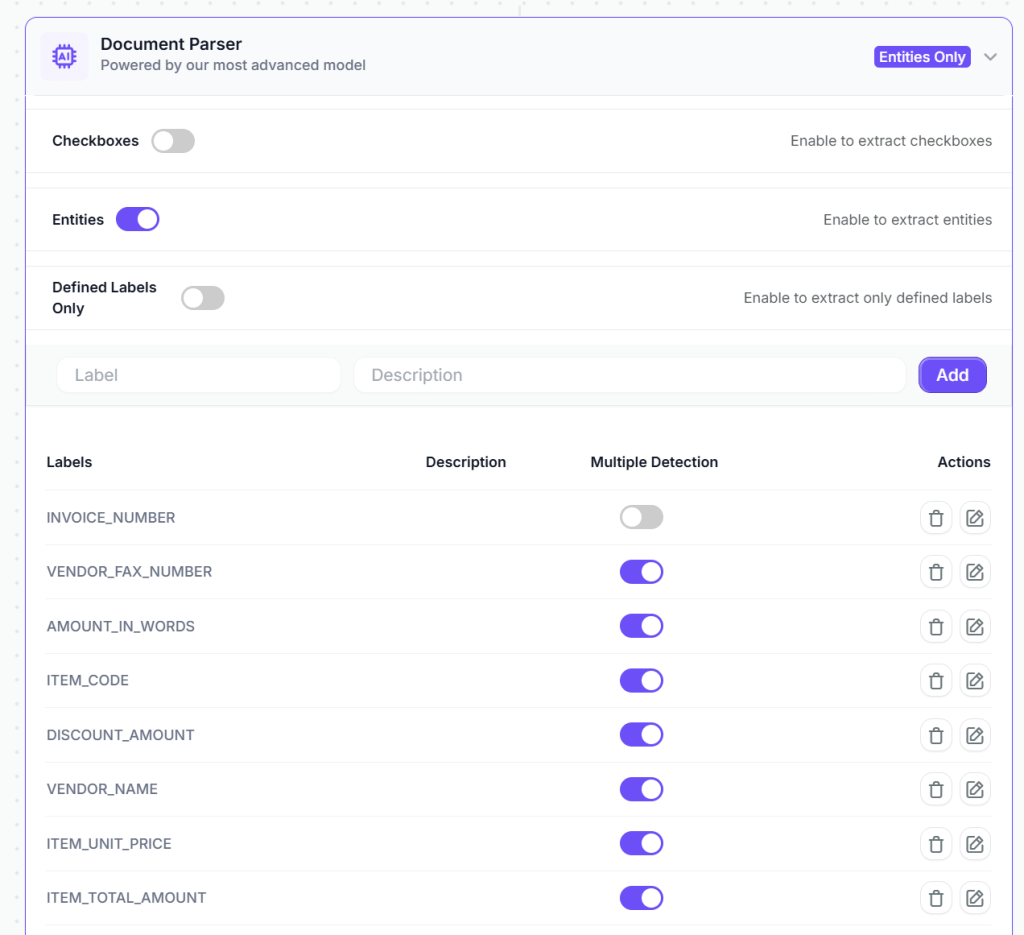

Add the Vision Language Model (VLM) Component:

Next, add a VLM component for every type of document you are working with to intelligently extract specific data fields. For example for financial statement analysis you can add a VLM to understand the structure and context, allowing it to locate relevant information regardless of document layout variations.

The VLM component in Kudra adapts to different vendor invoice formats automatically. You’re not building rigid templates that break when a vendor changes their invoice design—you’re teaching the system what information matters regardless of where it appears on the document.

Add Expert Analysis Through Text Generation Component

To generate comprehensive due diligence reports, add a text generation component configured to act as a business intelligence expert. This component takes the extracted financial data and produces a structured JSON report with financial ratio analysis, trend identification, risk assessment, and strategic recommendations.

Of course, the prompt should be far more detailed than this. What you’re seeing here is only a simplified snapshot.

The full, production-ready prompts—including structure, edge-case handling, and optimization tips—are shared exclusively inside our expert community.

Inside the Slack, you’ll get free access to:

The complete prompts we actually use in real workflows

Explanations of why each part exists (not just copy-paste text)

Iterations, improvements, and prompt updates as models change

Direct discussions with practitioners building and shipping this stuff

If you want to move beyond surface-level examples and start using prompts that actually work in real systems, join the Slack. It’s free—and it’s where we share the details we don’t post publicly.

Want the Full Prompt?

You can also chain multiple text generation components to create different expert perspectives:

- Financial Expert: Analyzes statements, calculates ratios, identifies financial health indicators

- Risk Assessment Expert: Evaluates regulatory compliance, operational risks, and market positioning

- Strategic Analyst: Provides investment recommendations and growth potential analysis

Each expert component outputs structured JSON that can be automatically converted into beautifully formatted reports.

Optional: Add Post-Processing Components

Depending on your specific requirements, you can add additional data refinement steps:

Find and Replace: Standardize vendor names that appear in multiple formats. For example, invoices showing “ABC Corp” and “ABC Corporation” can be automatically matched to your vendor master database.

Format Date: Convert dates to match your accounting system requirements. This ensures consistency across international vendors using different formats (DD/MM/YYYY vs MM/DD/YYYY).

Text Transformation: Apply formatting rules such as converting account codes to uppercase, standardizing currency symbols, or making other adjustments to ensure data consistency.

Optional Post-Processing: For basic invoice processing, the VLM and validation components usually provide clean, structured data without extra steps. These additional options are available when your business logic requires them.

Configure Export Destinations

Kudra AI lets you send extracted data wherever it’s needed. Connect directly to accounting software, ERP systems, spreadsheets, databases, or automation platforms like Zapier. Multiple destinations can run at the same time, giving your team full visibility and seamless integration without manual work.

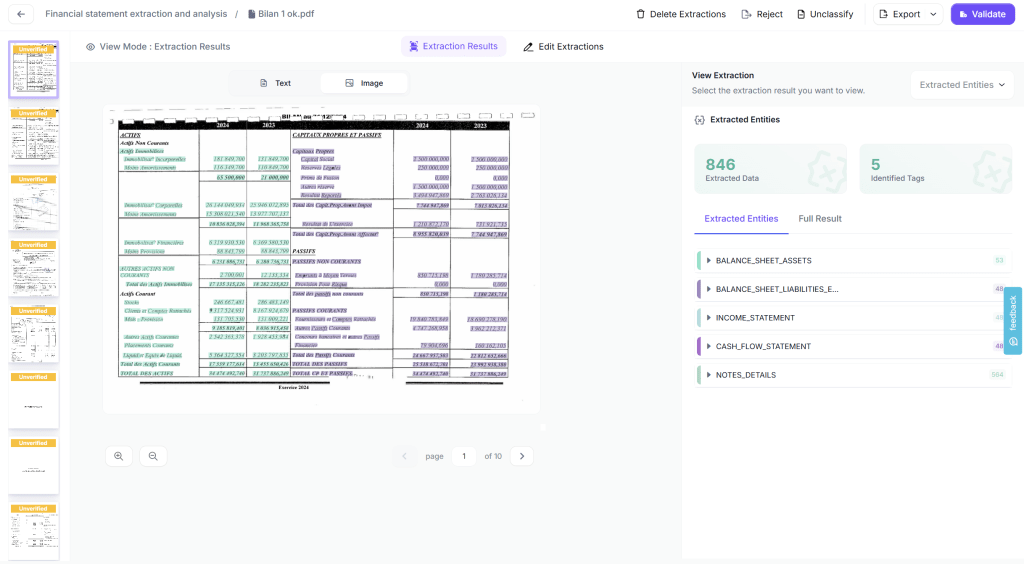

Step 4: Create a Production Project and Process at Scale

Once your workflow is ready, create a production project for ongoing invoice processing. In Kudra AI, click “Create New Project” and give it a descriptive name: “January 2026 Operating Expenses” or “Q1 Vendor Invoices” or “Accounts Payable – Ongoing.”

During project creation, select the workflow you just built from the dropdown menu. This links your automated data extraction workflow to this specific project, meaning every document uploaded to this project will automatically be processed according to your configured rules.

Now upload your due diligence documents. You can drag and drop files, upload entire folders, or connect to sources where documents arrive automatically such as email attachments, shared drives like Google Drive or Dropbox, or data rooms for transaction management.

Kudra AI processes each document set automatically, typically generating complete expert reports in minutes rather than the hours or days required for manual analysis. Processing runs in the background while you continue uploading additional documents or working on other tasks. There’s no need to monitor progress—the system handles everything automatically and delivers polished, expert-level reports ready for stakeholder review.

Once processing is complete, download the structured JSON output containing all extracted data and expert analysis. This JSON serves as the foundation for creating full-fledged, visually appealing reports. Transform the raw data into professionally formatted documents with custom branding, charts, tables, and executive summaries—like the example below:

The structured JSON format ensures you have complete flexibility to generate reports that match your organization’s standards and presentation requirements, whether for internal review, board presentations, or client deliverables.

Ready to Automate Your Reports?

Kudra AI provides automation specifically designed for investment funds, lending institutions, procurement teams, and M&A groups that need to evaluate businesses comprehensively using diverse document types. Our multi-format document processing, intelligent financial analysis, customizable evaluation frameworks, and automated report generation mean you can implement sophisticated due diligence workflows in weeks rather than months.

Process diverse document types: financial statements, business plans, contracts, presentations, and supporting materials—all through one workflow.

Want to see how automation works for your specific evaluation process? Book a free demo where we’ll process your actual due diligence documents (with sensitive information redacted) through Kudra AI and show you the generated investment memo or evaluation report. No sales pitch, just a practical demonstration of what automation delivers for your organization.