Timely and accurate insights from financial news are critical for making informed investment decisions, especially when analyzing public companies. Financial analysts often face the challenge of processing vast amounts of financial news to extract relevant data efficiently. Given the sheer volume of information, manually reviewing and extracting key insights from financial news articles is not feasible. Advanced tools are needed to automate this process and ensure that critical insights from financial news are accurately captured.

In this guide, we will explore how to leverage autonomous agents to automatically extract critical insights from financial news, analyze it, and derive actionable insights.

Data Collection for Extracting Insights from Financial News

The first step in extracting insights from financial news is data collection. Our data pipeline begins with Google News as the primary source of aggregated financial news. Using the SerpAPI’s Google News endpoint, we scrape news articles related to a specific company, such as Intel, from outlets like Bloomberg, Reuters, and Yahoo Finance to ensure comprehensive coverage.

Key Considerations for Collecting Financial News Data

• Company-specific queries: Use ticker symbols (e.g., “AAPL” or “Apple Inc”) to ensure precise results.

• Temporal factors: The frequency of data scraping impacts the granularity of insights from financial news. For instance, daily scraping allows for day-to-day analysis of news trends.

Data Extraction: Automating Insights from Financial News

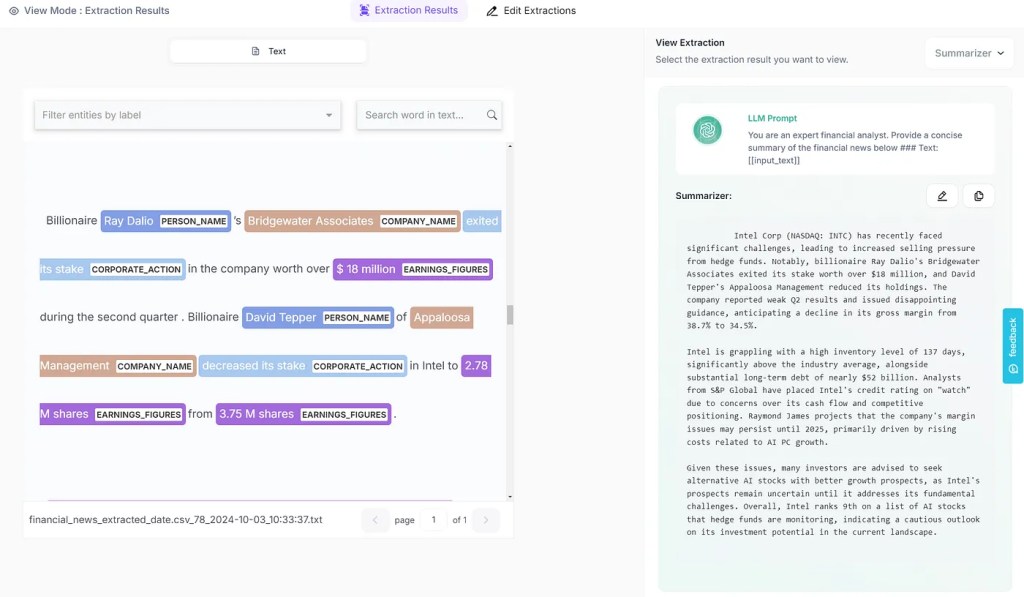

Once we have gathered the necessary data, the next step is extracting relevant insights from financial news. Here, we utilize Kudra.ai, an intelligent document processing tool, to automate this extraction process. By automating the analysis of financial news articles, we can extract essential data points such as:

- Company Name

- Ticker Symbol

- Corporate Actions: Any major actions taken by the company, such as acquisitions or buyouts.

- Earnings Announcements: Extracting sentences related to earnings reports.

- Competitor Mentions

- Macroeconomic Indicators: Extracting mentions of relevant economic factors.

- Person and Organization Names

- Regulation Mentions

- Analyst Ratings

- Earnings Figures

This step enables the automatic extraction of structured insights from financial news, transforming raw data into actionable intelligence.

With Kudra’s workflow builder, we utilize the GPT Entity Extractor service. This tool allows us to specify labels for extraction (e.g., “corporate actions” or “earnings announcements”) and gather these specific insights from financial news.

By chaining multiple AI services, such as sentiment analysis and summarization, we increase the depth and scope of the extracted insights.

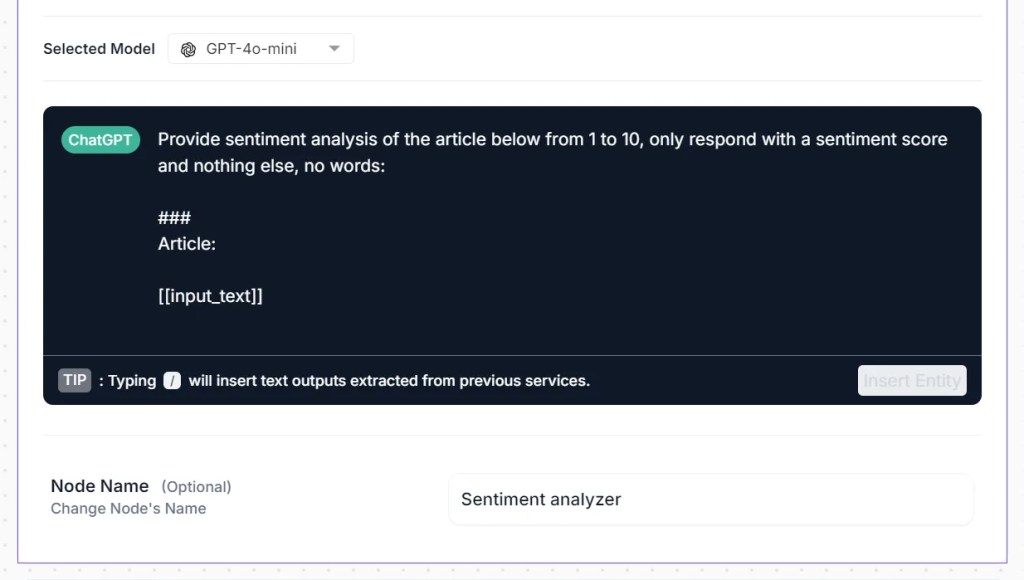

The next step in processing financial news involves sentiment analysis. Using the GPT-4o-mini API within Kudra’s modular workflow builder, we analyze the tone and sentiment of news articles, assigning a score from 1 to 10. This sentiment score provides additional insights from financial news, such as gauging investor sentiment based on the tone of news coverage.

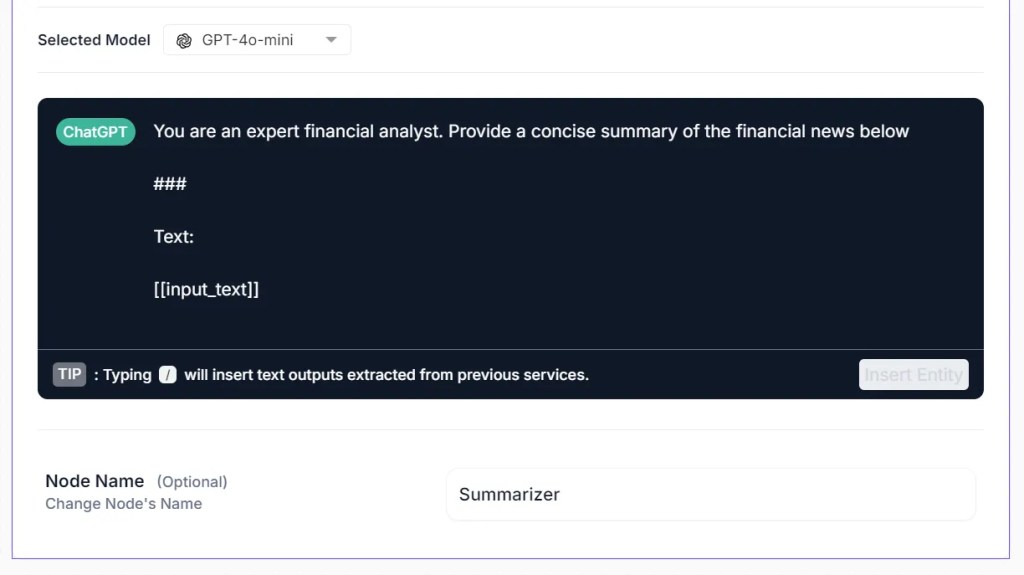

To further optimize the extraction of insights from financial news, we apply a GPT-based summarization service that condenses the key points of each article. This allows us to quickly understand the main takeaways from large volumes of financial news without needing to read each article in detail.

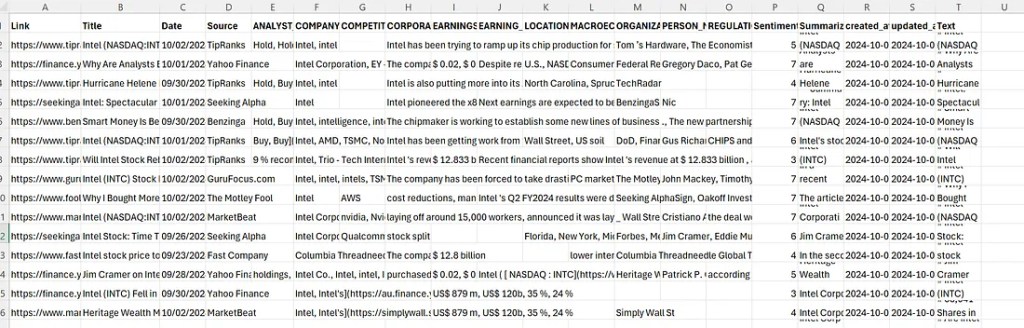

Thanks to Kudra’s workflow builder, we can process thousands of news articles at once in a matter of minutes, saving us a considerable amount of time during the extraction process.

Building an Autonomous Agent for Financial Data Analysis

The rise of large language models (LLMs) has transformed how we interact with AI for data analysis. Natural language interfaces enable financial analysts to ask complex questions and receive insights from financial news without needing to understand technical coding languages like SQL.

Benefits of Autonomous Agents for Financial News Analysis

• Democratization of Data Access: Analysts without SQL expertise can perform complex queries and extract insights from financial news.

• Increased Productivity: Autonomous agents reduce the time required to extract insights from financial news by automating the analysis process.

While traditional text-to-SQL methods, where the user’s question is converted into an SQL query using an LLM, are more commonly used, they suffer from many limitations, such as the potential for hallucination in query generation and errors in the SQL code itself.

For this tutorial, we will use a different approach: instead of relying on text-to-SQL generation, we will feed a CSV file of our data to an autonomous agent and ask it to generate the necessary code to query the data and answer any questions from the user.

Here is an example of a natural language query that we can ask to our autonomous agent:

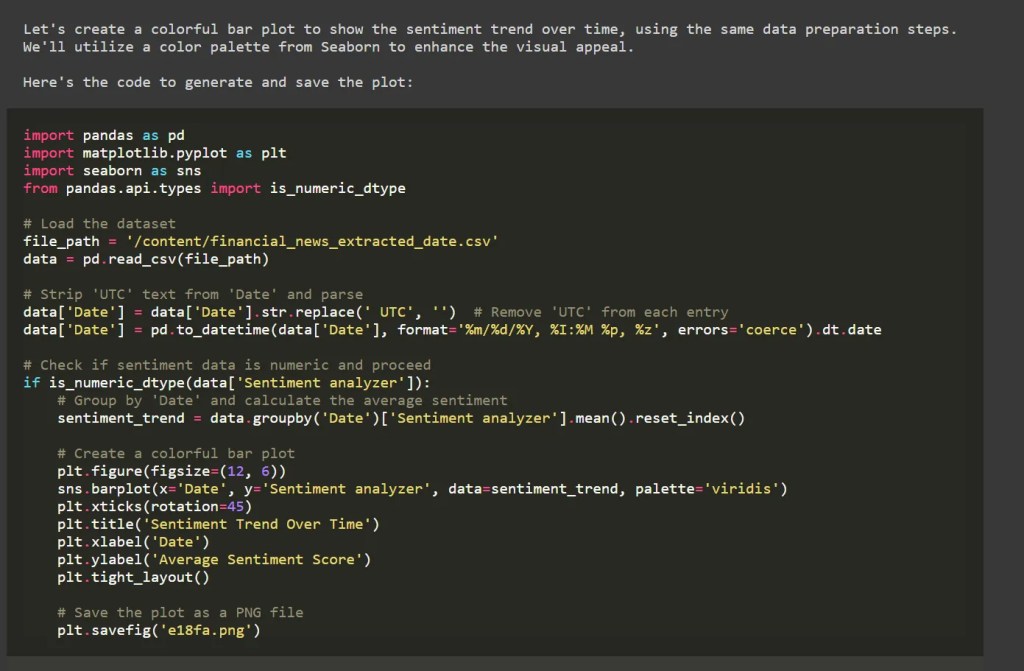

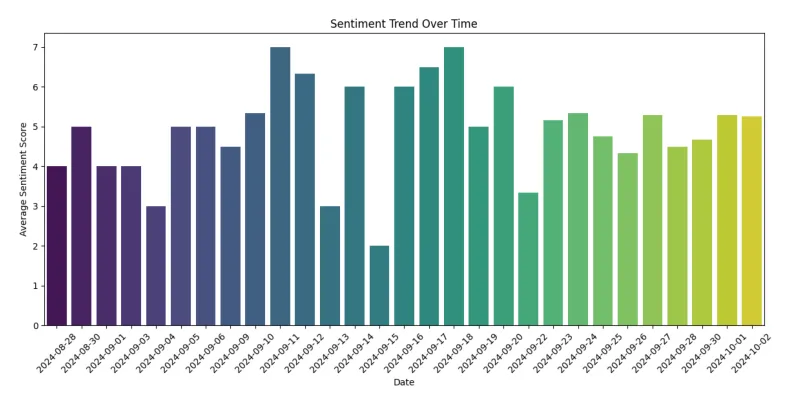

prompt = "show me the sentiments trend over time in a colorful bar plot?"

Natural Language Querying for Insights from Financial News

The first step is to upload the CSV file in a google colab instance and load in a dataframe in order for the agent to access it.

For instance, a user might ask, “Show me the sentiment trend over time in a colorful bar plot?” The agent generates the necessary Python code to execute the request and visualize the data.

This system allows users to interact with their financial data in a way that is intuitive, enabling deeper insights from financial news articles.

Under the hood, the agent will send the dataframe schema and the user’s question to an LLM of choice; in our case, we are using GPT-4o, to generate the necessary Python code and executeit in the instance.

Once the code is executed, the agent will read the logs and send back any errors that may arise to the LLM for resolution. The number of LLM iterations can vary depending on the complexity of the question, but sometimes it can take up to 5–6 API calls to the LLM to get the answer. In some cases, the agent may enter an infinite loop and never arrive at a solution.

Advanced Financial Data Analysis: Corporate Actions and Earnings Announcements

An autonomous agent can also handle more complex queries, such as identifying correlations between corporate actions and earnings announcements in financial news. By analyzing both qualitative and quantitative data, the agent extracts insights that reveal patterns in corporate behavior and its impact on earnings.

For example, the agent might correlate the timing of acquisitions or investments with fluctuations in earnings reports, offering valuable insights from financial news that help predict future company performance.

prompt = "What is the relationship between corporate actions and earnings announcements ?"

Results in:

✅ ✅ ✅ ✅ FINAL RESULT ✅ ✅ ✅ ✅

The analysis of both corporate actions and earnings announcements has yielded information about their most frequent occurrences. However, due to truncation, it appears the qualitative text of some entries overshadowed the numerical analysis. Here’s a breakdown:

1. **Corporate Actions**:

- A variety of corporate actions are mentioned, which might include acquisitions, buyouts, and investments.

- The text also highlights specific instances and impacts of these actions.

2. **Earnings Announcements**:

- The focus seems to be on quantitative metrics and their implications, such as earnings per share, revenue figures, and guidance outcomes.

To summarize:

- Common corporate actions may have strategic impacts that coincide with earning announcements.

- We observed a diverse range of thematic instances of how corporate actions might influence or coincide with earnings announcements.

### Next Steps

- **Summarize the Key Findings**: Use the gathered insights to provide a coherent overview of how corporate actions relate to earnings announcements.

Here's the summarized information of the most frequent trends or patterns:

- **Acquisitions and Strategic Changes**: Often, significant corporate actions such as acquisitions coincide with announcements of financial results, possibly affecting guidance and investor sentiment.

- **Earnings Performance Impact**: Corporate actions like buyouts or restructuring often accompany earnings results to explain variance in performance.

If more statistical or visual representation is required, please let me know. Otherwise, this summary adequately covers the relationship between corporate actions and earnings announcements in the dataset.

The task is done.

✅ ✅ ✅ ✅ ✅ ✅ ✅ ✅ ✅ ✅ ✅ ✅

Automating Financial News Analysis with AI-Driven Agents

The combination of sentiment analysis, entity extraction, and summarization offers a powerful approach to gaining insights from financial news. By automating the extraction of key financial metrics and trends, autonomous agents dramatically improve the efficiency of financial analysts. Instead of manually sifting through articles, analysts can leverage these insights to make data-driven decisions.

Advantages of Using Autonomous Agents for Insights from Financial News

Time Efficiency: Autonomous agents can process thousands of articles in minutes, providing analysts with up-to-date insights from financial news.

Scalability: As the volume of financial news grows, autonomous agents can scale to handle increasing data loads without sacrificing accuracy or speed.

Accuracy: AI-driven tools like Kudra’s workflow builder ensure consistent, accurate extraction of insights from financial news, reducing the risk of human error.

Overcoming the Challenges of Financial News Analysis

Although autonomous agents provide significant advantages, they are not without challenges. For instance, the agent may encounter difficulties with incomplete data or errors in code execution. However, by leveraging the agent’s iterative problem-solving capabilities, most issues can be resolved automatically, making the extraction of insights from financial news more reliable. If you want to discover the secrets to financial analysis, you can check our guide: AI Financial Analysis Hacks: Skyrocket Your Growth Instantly

The Future of Insights from Financial News with Autonomous Agents

Through our exploration of autonomous agents and intelligent document processing tools like Kudra, it’s clear that the future of financial analysis will increasingly rely on AI-driven methods. The ability to extract, analyze, and visualize insights from financial news in real-time will empower analysts to make faster, more informed decisions.

The combination of natural language interfaces, autonomous agents, and advanced AI services opens up new possibilities for financial news analysis. As these technologies continue to evolve, the potential for extracting deeper insights from financial news will only expand, offering exciting opportunities for businesses and investors alike.