The insurance industry has long relied on manual processes for handling claims, leading to delays, errors, and inefficiencies. But now, with the advent of claims process automation, insurance companies can revolutionize how claims are reviewed, validated, and approved. Automating the claims approval process with the help of AI reduces the time it takes to settle claims and improves overall accuracy, delivering significant benefits to insurers and policyholders alike. In this article, we explore how automated claims management and AI claims processing streamline claims approval, enhance accuracy, and optimize operational efficiency.

In this article, we’ll explore the role of AI in automated claims management, focusing on how it enhances claims processing, reduces manual errors, and transforms the future of insurance claims handling.

What is Automated Claims Management?

At its core, automated claims management involves the use of artificial intelligence (AI), machine learning, and robotic process automation (RPA) to automate various stages of the insurance claims process. From claims submission to final settlement, automation replaces manual tasks and speeds up decision-making.

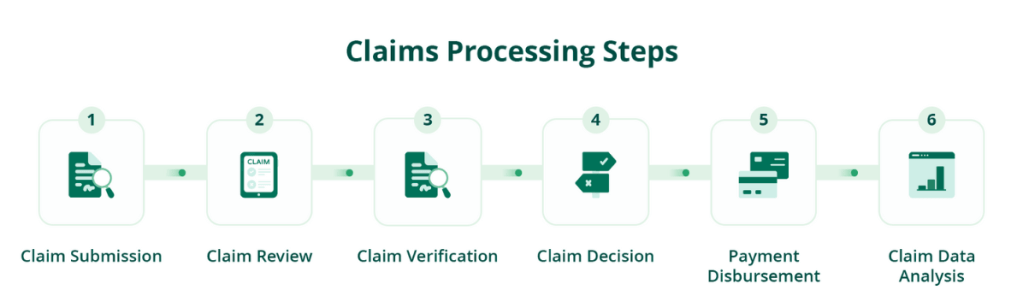

Key Stages in Automated Claims Management:

- Claims Submission: AI-enabled systems capture and verify data from submitted claims automatically.

- Claims Verification: AI cross-checks claims data with policy details to ensure compliance.

- Fraud Detection: AI identifies potentially fraudulent claims for review.

- Claims Approval: After verification, the system approves settlement claims based on predefined rules.

Benefits of Automated Claims Management

Automating claims approval offers multiple advantages, from increased efficiency to improved customer satisfaction. Below, we highlight the most significant benefits of AI claims processing in the approval process.

1. Faster Approval Times

Manual claims review can take days, but with automated claims management, the approval process is streamlined, enabling insurers to handle high volumes of claims efficiently. This means policyholders receive quicker responses and payouts.

2. Enhanced Accuracy

AI eliminates human error in data entry, claims matching, and fraud detection. By automating these tasks, insurers can ensure claims are processed with greater accuracy, leading to fewer disputes and corrections.

3. Cost Savings

Automation reduces labor costs associated with manual claims processing and minimizes operational expenses. With AI handling the bulk of approvals, insurers can process more claims without needing to scale their workforce.

4. Improved Fraud Detection

AI-driven fraud detection algorithms analyze claims patterns and flag unusual activity. This helps insurers prevent fraudulent claims from being approved, saving significant amounts in payouts and reducing financial risk.

5. Better Compliance

Automated systems ensure that claims are processed according to compliance rules and regulations. By integrating legal frameworks into the automation process, insurers can avoid costly penalties for non-compliance.

How AI Powers Automated Claims Approval

AI is the backbone of automated claims management, using advanced algorithms and machine learning to improve every aspect of the claims process. Here’s how AI works to automate claims approval.

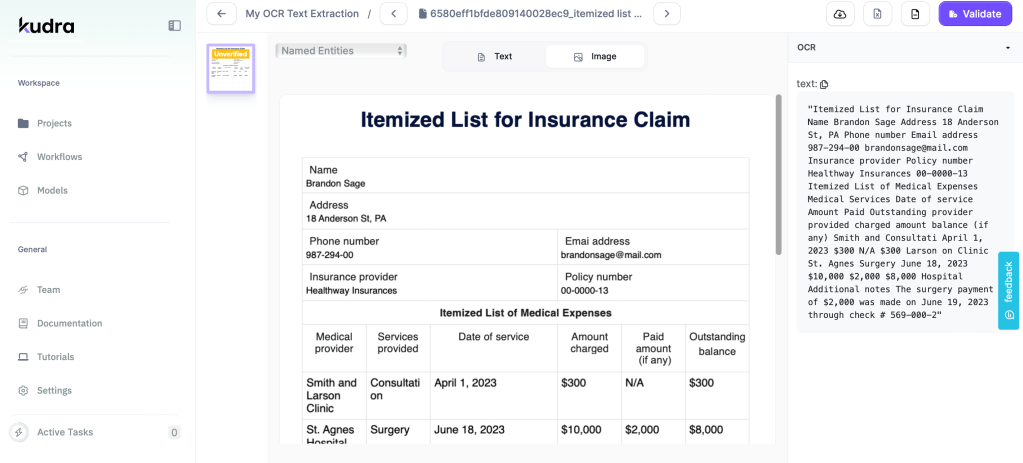

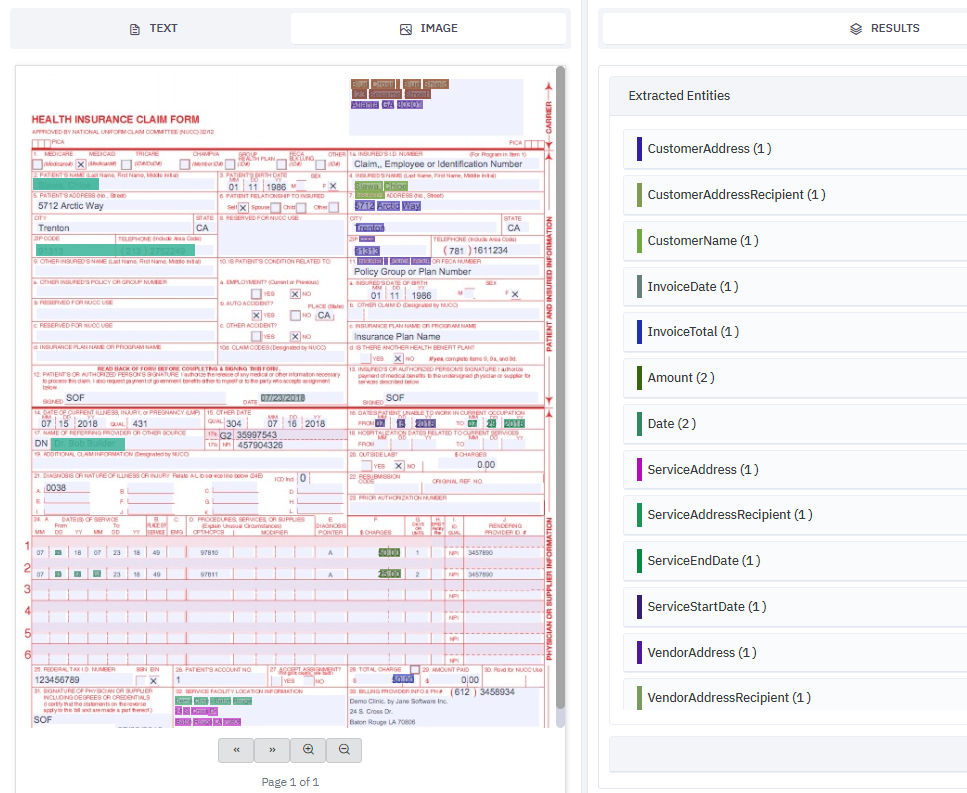

1. AI-Driven Data Extraction

AI tools like Optical Character Recognition (OCR) extract and digitize data from claims forms, medical reports, and invoices. This allows the system to process vast amounts of data quickly, ensuring that all necessary information is captured accurately.

2. Automated Decision Making

AI models use predefined rules to decide whether a claim should be approved or rejected. For instance, AI can approve low-risk claims automatically, while routing complex or high-risk claims to human adjusters for further review.

3. Predictive Analytics

By analyzing historical claims data, AI systems predict outcomes and suggest the most efficient route for claim approvals. This predictive capability not only speeds up approvals but also improves risk assessment accuracy.

4. Fraud Detection with Machine Learning

AI systems learn from past fraudulent cases, enabling them to identify patterns of suspicious behavior. When fraud is detected, the system automatically flags the claim, preventing illegitimate approvals.

Overcoming Challenges in Automated Claims Management

Despite the many benefits, insurers may face challenges when implementing claims process automation. Below are some common issues and how they can be addressed.

1. Legacy System Integration

Many insurers still rely on outdated systems that may not easily integrate with modern AI tools. To overcome this, insurers need to adopt scalable automation platforms that can be integrated with existing legacy systems.

2. Data Privacy and Security

With automated claims approval comes the responsibility of securing sensitive customer data. Insurers should implement strong encryption protocols and ensure that all automated systems comply with data protection regulations.

3. Maintaining Human Oversight

While automation can handle a significant portion of claims approvals, complex cases may still require human intervention. AI should complement human decision-making, not replace it entirely, especially for high-risk claims.

Best Practices for Implementing Automated Claims Approval

To successfully implement AI claims processing and automation in claims approval, insurers must adopt best practices that ensure a smooth transition.

1. Define Clear Approval Rules

Automated systems rely on predefined rules to approve claims. It’s crucial to establish clear criteria for claims approval, including risk levels, policy terms, and fraud indicators.

2. Leverage AI for High-Volume Claims

Start by automating the approval of straightforward, high-volume claims. This allows insurers to realize quick wins and gradually scale up to more complex claims.

3. Train Staff on AI Tools

While AI handles much of the approval process, human staff need to understand how to use these tools effectively. Proper training ensures that employees can monitor AI performance and step in when necessary.

4. Monitor and Optimize

Regularly monitor the performance of your automated claims system. Use analytics to identify

Kudra: The Ultimate Solution for Automated Claims Management

Kudra offers a comprehensive claims process automation solution that empowers insurers to automate claims approval efficiently and accurately. With Kudra, insurers benefit from:

• AI-Driven Claims Processing: Automate every step of the claims approval process using advanced AI models.

• Customizable Approval Workflows: Tailor the system to fit specific business rules and policy requirements.

• Seamless Integration: Integrate Kudra with your existing systems to streamline data flow and enhance operational efficiency.

Kudra provides the tools you need to enhance accuracy, reduce processing times, and improve customer satisfaction through automated claims management.

The Future of Claims Approval is Automated

The benefits of claims process automation are clear: faster approvals, reduced errors, improved fraud detection, and enhanced customer satisfaction. By adopting AI-powered automated claims management, insurers can streamline their approval processes, reduce costs, and stay ahead in a competitive market.

As AI continues to evolve, automating claims approval will become the standard in the insurance industry, enabling insurers to offer faster, more accurate, and more reliable claims services.