Imagine a world where bank reconciliation isn’t a laborious, time-consuming process but instead, a smooth and efficient part of your treasury management. That’s the reality with AI.

This article will introduce Kudra, an AI platform capable of extracting and analyzing complex data from various documents to automate the bank reconciliation process. We’ll compare the traditional manual approach to reconciliation with Kudra’s AI-powered solution, highlighting key benefits like enhanced efficiency, reduced costs, and improved accuracy.

Traditional Bank Reconciliation vs. Generative AI Approach

Bank reconciliation has long involved tedious manual processes of collecting bank statements, identifying transactions, resolving discrepancies between the bank balance and book balance, and more. This traditional approach is prone to human error, leading to incorrect financial reporting. It also requires significant time and effort from accounting teams each month.

Common pain points include:

– Time-intensive process of obtaining, organizing, and reviewing statement data

– Difficulty identifying unauthorized transactions or fraud

– Delayed financial reporting impacting cash flow visibility

– Increased compliance risk from errors and inaccuracies

Many organizations rely on generic Treasury Management Systems (TMS) to assist with bank reconciliation.

However, these systems have limitations:

– Rigid workflows unable to handle complex reconciliation needs

– Limited automation requiring significant manual work

– Lack of customization hampering efficiency

– Minimal analytical capabilities restricting actionable insights

In contrast, AI-powered solutions like Kudra overcome these challenges through intelligent data extraction and analysis. Kudra’s flexible platform automates reconciliation tasks while enhancing accuracy. This reduces the burden on accounting teams, allowing them to focus on value-adding activities.

Introduction to Kudra's Intelligent Document Processing Solution

Reconciling bank statements in 2024 has come a long way from the manual traditional approach; Kudra provides an AI platform specializing in data extraction and document analysis. Its visual workflow builder allows users to develop customized systems that can rapidly process information from different document types.

Key capabilities include:

– Advanced optical character recognition (OCR) to extract text, tables, and handwritten notes

– Intelligent document classification and entity recognition

– Automated data extraction into various endpoints

– Custom AI modeling for specialized needs

– ChatGPT integration enabling natural language queries

This enables the rapid transformation of unstructured data from bank statements, contracts, invoices, and more into actionable insights.

Deep Dive into Kudra's Unique Offerings

Let’s explore some of Kudra’s stand-out features:

• Visual Workflow Builder

The drag-and-drop workflow builder allows anyone to develop automated workflows tailored to their specific document analysis needs, with no coding required. Customized data extraction pipelines can be set up in minutes.

• Multi-format Processing

Kudra can ingest data from PDFs, Word documents, CSVs and even images. The AI integration ensures precision when handling elaborate documents like financial reports or shipping manifests.

• ChatGPT Module

This add-on helps handle abstract tasks using conversational prompts. It assists with summarization, text generation, document classification and more. For bank reconciliation, the ChatGPT module can analyze statement details or transaction descriptions to flag suspicious activity.

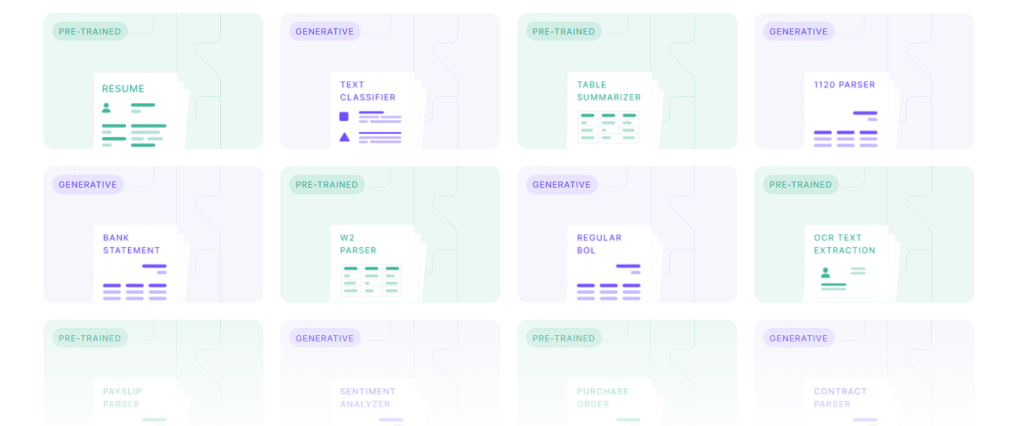

• Pre-trained AI Templates

Kudra offers an AI app store with over 20 templates for common financial documents like invoices, purchase orders, and W2 forms. This allows easy customization for bank statement reconciliation needs.

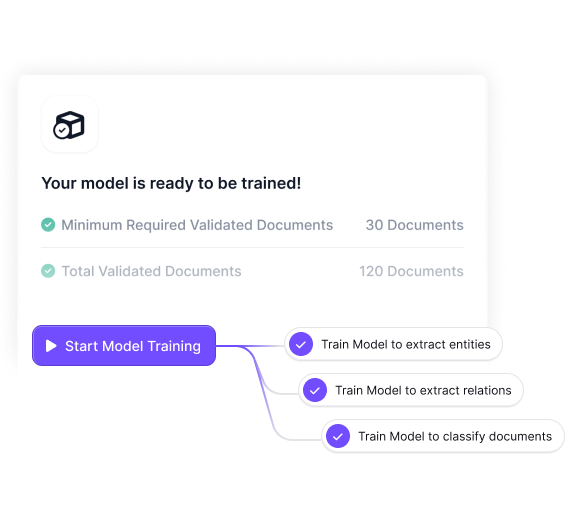

• Custom AI Model Training

For more complex reconciliation tasks, Kudra allows training custom AI models using labeled examples. This boosts accuracy when extracting information from intricate bank statements.

Speed, Efficiency, and Ease of Use of Generative AI with Kudra

Kudra accelerates document processing through automation while retaining precision. Built-in AI capabilities allow the rapid ingestion and transformation of statement data into usable formats. This enables dynamic reconciliation and reporting.

With an intuitive drag-and-drop interface, minimal training is required. This allows accounting teams to quickly build reconciliation workflows aligned to their needs, freeing up resources.

Kudra’s pre-configured AI templates further simplify getting started with bank statement automation. Users can immediately extract essential data like transaction dates, descriptions, and amounts after uploading PDF bank statements.

Enhancing Bank Reconciliation with Kudra's Generative AI

Now let’s review key ways Kudra optimizes and enhances bank reconciliation processes:

• Identifying Discrepancies

Kudra’s AI continuously learns and improves at spotting irregularities between statement transactions and recorded activity. This allows for dynamic detection of unauthorized charges or potential fraud.

• Transaction Classification

Intelligent document processing assists with categorizing statement line items. This eliminates manual transaction tagging, improving reconciliation efficiency.

• Reconciliation Reporting

Key statement details extracted by Kudra can automatically populate reconciliation reports, removing manual collation needs while reducing errors.

• Ongoing Process Improvements

Kudra’s analytics provide visibility into process bottlenecks like transaction matching failures, allowing accounting teams to continuously refine workflows.

The platform’s agility empowers teams to easily tweak systems. Additional documents or new reconciliation requirements can be incorporated through simple drag-and-drop workflow adjustments.

Conclusion

Kudra provides a cutting-edge solution for supercharging reconciliation processes using AI. Core capabilities around document digitization, data extraction, and intelligent analytics help automate previously manual efforts. This saves valuable time while enabling accurate, real-time visibility into cash positions.

With powerful features like customizable workflows, multi-format ingestion, and ChatGPT integration, Kudra meets diverse reconciliation needs. Pre-trained AI templates allow fast setup while custom models ensure precision on complex statements.

As organizations aim to streamline reconciliations, Kudra’s intelligent platform offers the flexibility and performance to keep up with evolving demands (you can check our guide What are the steps to bank statement extraction? for further information). The future of bank reconciliation is AI-powered – and Kudra stands ready to be the intelligent automation partner for every business.