The integration of artificial intelligence (AI) is radically transforming traditional finance functions. From banking to insurance to investment strategies, AI is redefining processes, enhancing efficiency, and enabling improved decision making. However, while AI unlocks immense potential, its implementation also poses ethical concerns and practical challenges that the finance sector must address.

This blog aims to shed light on the evolving role of AI in finance, how solutions like Kudra’s AI platform assist in improving processes, and the potential challenges and future impact of wider AI adoption across the industry.

AI in Finance 101

Before exploring the transformative power of AI in finance, let’s first understand what it is and its current applications in the sector.

At its core, AI refers to computer systems designed to perform tasks that typically require human intelligence. In finance, AI takes over repetitive and data-intensive tasks from professionals, analyzes troves of data to detect patterns and derive insights faster than humans can, and makes predictions that support better strategic decisions.

Key areas where AI is making inroads in finance include:

• Banking: AI chatbots handle basic customer queries, while process automation is carried out by robotic process automation (RPA) bots undertake tasks like loan processing. AI also assists in predictive analytics for credit risk assessment.

• Insurance: AI expedites essential processes like claims management and fraud detection through pattern recognition. It also enables insurers to develop customized premiums and personalized policy offerings.

• Investment Management: AI aggregates news and data to identify opportunities and risks to make sound investment decisions rapidly. It also creates algorithms that mirror human trading patterns.

By taking over time-consuming manual tasks and augmenting human capabilities, AI delivers the following key benefits:

– Increased Efficiency: AI automation of repetitive processes like data entry and report generation boosts productivity.

– Faster Detection of Patterns and Trends: AI rapidly spots correlations and emerging trends by continuously analyzing massive data sets to inform decisions.

– Improved Risk Assessment: AI modeling more accurately predicts threats and downside risks.

– Higher Revenues: Hyper-personalized offerings and optimized processes directly enhance profitability.

With immense potential to revolutionize finance, what does Kudra’s AI-powered document processing solution offer?

Kudra’s Intelligent Document Processing Solution: The AI Powerhouse in Finance

Kudra’s end-to-end AI platform specializes in extracting and structuring data from complex financial documents with ease.

It delivers intelligent document processing capabilities leveraging computer vision, natural language processing (NLP), and machine learning. This enables the analysis of unstructured documents like bank statements, contracts, and invoices across formats such as PDFs, scanned images, and handwritten notes.

Kudra’s solution offers immense value to financial institutions through:

– Speed and Precision: AI instantly identifies and extracts relevant entities from documents and moves them into predefined templates for seamless data capture. This level of accuracy and pace is impossible to match manually.

– Ease of Use: With an intuitive drag-and-drop interface, anyone can set up and customize automated workflows tailored to their needs without coding skills.

– Advanced Analytics: Kudra’s NLP algorithms and machine learning models derive context and uncover insights from text and tables that humans would likely miss.

In addition, the integration of Kudra’s ChatGPT module adds a reasoning layer to workflows by enabling users to leverage the conversational AI to handle tasks like:

• Analyzing contract clauses

• Summarizing documents

• Classifying paperwork

• Spotting inaccuracies in reports

• Suggesting actions based on extracted info

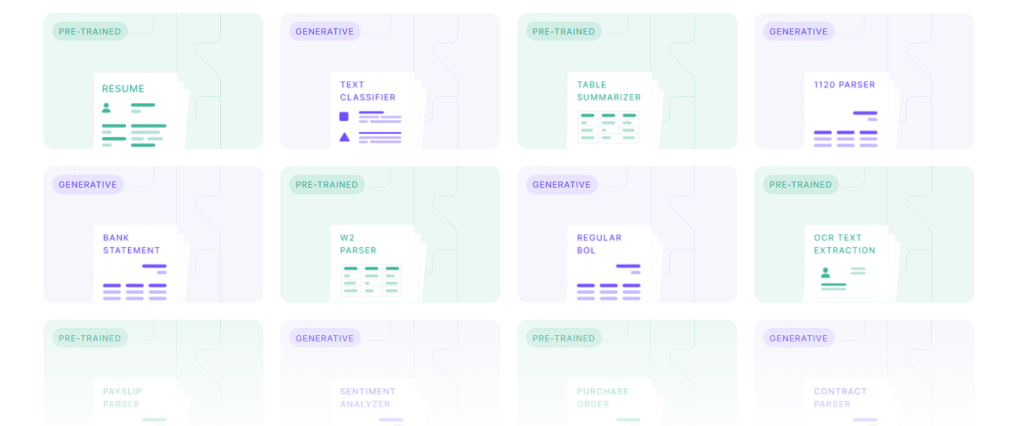

With over 20 pre-trained AI templates for financial documents, the ability to train custom models, and seamless integration with popular apps like QuickBooks and Google Sheets, Kudra delivers a powerful automation solution.

The result? Faster processing, fewer errors, and more strategic financial decision-making. However, while promising better efficiency and productivity, implementing AI also poses challenges.

Challenges of Implementation of AI in Finance

As AI becomes integral to financial processes, some key challenges around ethics, security, and regulation require consideration:

• Data Quality and Security: Since AI learns from data patterns, low-quality data with biases or errors gets amplified in automated decisions. Protecting sensitive customer data is also critical.

• Regulatory Restrictions: Usage restrictions around AI exist currently in finance. More regulations are expected as technology evolves.

• Ethical Concerns: AI must be monitored to prevent unfair outcomes due to algorithmic bias or lack of transparency in automated decisions.

To leverage AI responsibly, financial institutions must implement sound data governance frameworks, audit algorithms to ensure fairness, and keep pace with emerging regulations. The right governance is key to managing risks.

The Future of AI in Finance

While AI integration currently focuses on driving efficiency in individual processes, the future roadmap involves organization-wide transformation:

• Enhanced Data Analysis and Automation: With troves of data becoming available via APIs, AI will undertake sophisticated forecasting and reveal granular insights for precise decision-making.

• Altered Job Roles: As bots and algorithms take over repetitive tasks, the need for roles like data analysts and AI specialists will grow. However, AI is expected to augment rather than replace human roles.

• Oversight for Responsible AI: To ensure fairness and transparency, roles overseeing model risk management will gain prominence to audit AI tools and address ethical issues.

The finance sector stands at an inflection point with AI adoption. With solutions like Kudra leading the way in enabling intelligent automation, AI is undoubtedly set to revolutionize how financial institutions operate. However, realizing AI’s full potential requires addressing emerging challenges around governance and ethics responsibly. The future belongs to financial organizations that leverage AI both strategically and conscientiously.

Conclusion

Explore how Kudra’s AI platform can assist your business in enhanced document processing, data insights, and accelerated growth. Our end-to-end solution powered by computer vision, NLP and machine learning helps build automated, customizable workflows that extract actionable data from complex paperwork.

Contact us today to learn more about our capabilities and how we can boost your productivity.