The Future of Health Insurance document processing

Health Insurance

Insutech

AI

SaaS

Document processing

7 min read · Dec 06th, 2023

The efficient processing of diverse Health Insurance documents plays a pivotal role in ensuring smooth operations, accurate billing, and timely claims processing. However, the manual handling of extensive paperwork poses numerous challenges, ranging from human errors to delays in claims approval.

This article delves into the challenges of document processing in health insurance, emphasizing the imperative for innovation, and explores the transformative benefits of Artificial Intelligence in this domain.

Challenges of Document Processing in Health Insurance

This sector deals with a plethora of documents, each holding critical information. Insurance policy documents entail complex clauses and terms, making manual extraction and summarization prone to errors. Claim forms, laden with medical jargon and detailed treatment information, often demand meticulous scrutiny. Medical bills, explanation of benefits, and enrollment forms contribute to the document complexity, requiring comprehensive processing.

Insurance Policy Documents:

Extracting relevant details, such as policyholder information, coverage limits, and premium amounts, from voluminous policy documents poses a significant challenge.

Claim Forms:

Understanding and processing diverse medical treatments, diagnoses, and provider information from claim forms demands precision and accuracy.

Medical Bills:

Deciphering itemized charges, service dates, and treatment details within medical bills requires a thorough understanding of medical coding.

Explanation of Benefits (EOB):

Analyzing EOB documents for covered services, payment details, and patient responsibilities involves meticulous data extraction and summarization.

Enrollment Forms:

Accurate processing of enrollment forms, including personal information and coverage details, is crucial for maintaining up-to-date insurance records.

The Need for Innovation

In the face of these challenges, this industry is compelled to embrace innovation. The sheer volume and complexity of documents necessitate a shift from manual processing to automated solutions. The need for accuracy, efficiency, and timely decision-making in the processing of health insurance documents is driving the exploration of AI technologies.

Introducing Kudra: AI Document Processing Solutions for Health Insurance

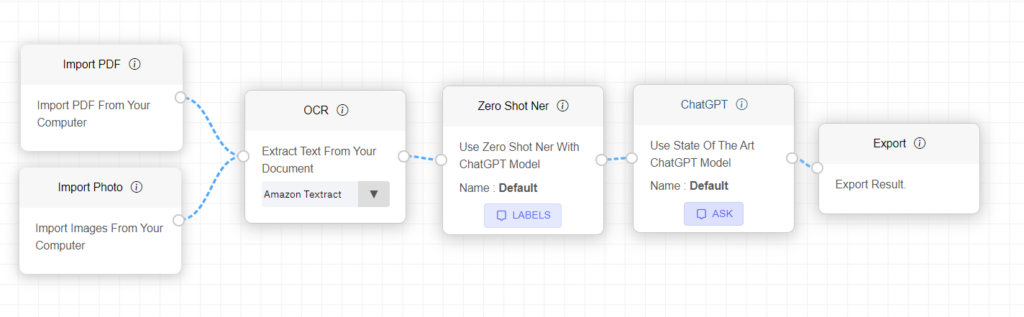

Kudra stands as an advanced solution crafted to transform document capture and processing within the health insurance sector. Its versatile feature set has been customized to address the distinctive challenges and demands encountered by health insurance professionals, encompassing Optical Character Recognition (OCR), table extraction, Form Recognizer, and Large Language Models (LLMs).

Let’s explore how these features are particularly relevant to enhancing efficiency and accuracy in this industry:

OCR (Optical Character Recognition):

Kudra’s OCR technology excels in extracting text from health insurance documents, such as policies, claims, and medical records, with unmatched precision. By eliminating the need for time-consuming manual data entry, it reduces errors and ensures document accuracy. OCR transforms physical documents into digital formats, facilitating easy search and retrieval in the realm of health insurance.

Table Extraction :

Kudra’s table extraction functionality simplifies the extraction of tables commonly found in health documents, which often contain crucial data like policy details, coverage limits, and claim information. This feature converts tabular data from policy documents, claims forms, and explanation of benefits (EOB) into a structured digital format, enhancing data organization and accessibility for health insurance professionals.

Form Recognizer:

Kudra’s Form Recognizer proves invaluable for health insurance documents by automatically categorizing entities such as policy details, claim information, and patient records. It streamlines the sorting and organization of documents such as policy forms, claim forms, and medical records, reducing manual effort and expediting processing tasks. Health insurance teams can swiftly locate and share pertinent documents, enhancing collaboration and overall efficiency.

LLMs for Classification and summarization:

By leveraging Kudra’s Large Language Models (LLMs), accurate classification of health insurance documents into categories like policy terms, claim details, and medical records enhances document indexing. This makes it easier to access specific documents within a database, improving compliance and expediting document retrieval for insurance professionals.

Moreover, by harnessing the power of ChatGPT, Kudra not only accurately categorizes health insurance documents but also serves as a valuable asset in summarizing policy details or extracting relevant information for faster decision-making.

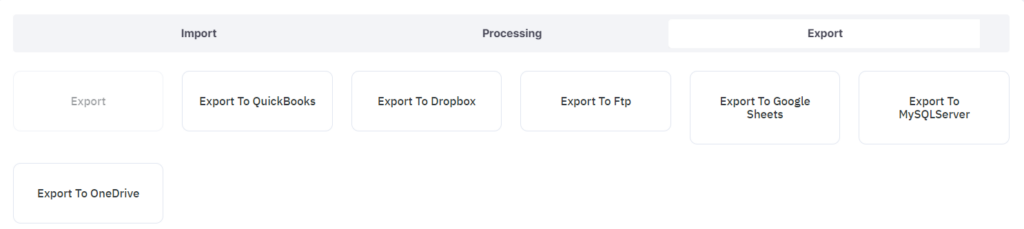

Multiple Export Options:

Those professionals benefit from Kudra’s various export formats, including PDF and JSON, to accommodate a range of project requirements. These formats enable seamless document sharing, archiving, and collaboration, supporting diverse needs such as policy presentations, regulatory compliance, and document record-keeping in the dynamic field of health insurance. Kudra’s comprehensive approach not only streamlines document processing but also enhances collaboration, enabling health insurance professionals to make more informed decisions and ultimately improve their workflow strategies.

Customized Document Processing Workflows for Health Insurance Success with Kudra

Kudra stands out as a solution equipped with robust features designed to elevate operational efficiency. Its exceptional adaptability to the specific demands of the health insurance industry sets it apart.

Adaptability and Continuous Learning:

Kudra’s AI technology is anything but a one-size-fits-all solution; it comprehends the intricacies of the health insurance sector and the unique processes within your business. This adaptability allows Kudra to become increasingly efficient and effective as it familiarizes itself with the nuances of your operations. Through continuous learning from your inputs and interactions, Kudra evolves into a trusted partner, assisting you in reclaiming time from routine document-related tasks.

User-Friendly Interface for Customized Workflows:

Kudra’s intuitive interface empowers you to effortlessly create customized workflows without the need for advanced coding skills. The drag-and-drop workflow creation feature makes it easy for you to adapt Kudra to meet the specific needs of your business. This user-friendliness ensures that you can fine-tune document processing workflows to align perfectly with your health insurance operations, enhancing efficiency without technical complexity.

AI-Enhanced Precision: Learning from Interactions:

Kudra’s AI capabilities transcend mere automation; they actively enhance your workflow by learning from your interactions. Every correction, input, or introduction of a new document type serves as a learning opportunity for Kudra, making it progressively more accurate. Kudra becomes finely tuned to your unique business needs, optimizing efficiency and accuracy. With Kudra, the future of health insurance document processing is not just automated; it’s intelligently adapted to your evolving operational requirements.

Why Choose Kudra ?

Kudra’s Distinctive Benefits Extend Beyond Conventional AI Document Processing Tools. It not only excels in health insurance document processing but also introduces a new standard of efficiency, precision, and cost-effectiveness to the sector.

Cutting Data Entry Costs and Reducing Errors Significantly:

Kudra revolutionizes health insurance document processing, reducing manual work by a significant margin, allowing your team to focus on value-added tasks.

Kudra’s automation plays a crucial role in reducing human errors by a substantial 95%, ensuring consistent and accurate data processing. With an impressive 80% reduction in data entry costs.

By automating document processes, Kudra liberates your valuable time and resources, allowing you to concentrate on the essential aspects of your health insurance business. You can direct your efforts toward nurturing client relationships, expanding your policy portfolio, and optimizing returns on health insurance investments. Kudra’s automation ensures that your document-related workflows run seamlessly, enabling you to focus on strategic decision-making and growth opportunities.

The Benefits of AI Document Processing in Health Insurance:

AI document processing platforms offer a transformative solution to the challenges inherent in health insurance document processing. Here are the key benefits:

- Enhanced Accuracy:

AI algorithms excel at extracting and summarizing information accurately, reducing the risk of errors associated with manual processing. This ensures that policy details, claims, and medical records are interpreted with precision.

- Increased Efficiency:

Automation through AI significantly speeds up the document processing workflow. This efficiency is particularly crucial in handling large volumes of claims, enabling timely approvals and reducing processing times.

- Improved Fraud Detection:

AI systems can analyze patterns and detect anomalies, aiding in the identification of potential fraud. This is especially pertinent in health insurance, where fraudulent claims can have significant financial implications.

- Customized Data Extraction:

AI models can be trained to extract specific data points from diverse documents, adapting to the unique requirements of health insurance policies, claim forms, and other documents.

- Streamlined Communication:

Automated systems facilitate seamless communication by summarizing and extracting key information from correspondence, enabling faster response times and better customer service.

- Cost Savings:

By reducing the reliance on manual labor and minimizing errors, AI-driven document processing leads to cost savings for insurance providers. The streamlined workflow also allows for optimal resource allocation.

Conclusion

In conclusion, the future of health insurance document processing lies in the transformative power of Artificial Intelligence. The challenges associated with manual handling of diverse documents can be mitigated through the precision, efficiency, and adaptability that AI brings to the table. As the industry continues to evolve, embracing innovative solutions becomes not only a necessity but also a strategic imperative for ensuring accuracy, efficiency, and customer satisfaction in the dynamic world of health insurance.

The integration of AI in document processing heralds a new era where technology serves as a catalyst for positive change in the healthcare insurance landscape.

If you’re interested in automating your data extraction process from health insurance documents, sign up for a free demo with Kudra now.