In today’s fast-paced business landscape, the ability to process financial documents quickly and accurately is essential. Manual data entry, which was once the standard for invoice processing, is prone to errors, delays, and inefficiencies. Enter Invoice OCR Software, a game-changer in the world of accounts payable automation. Optical Character Recognition (OCR) transforms scanned invoices or digital documents into machine-readable data, vastly improving the speed and accuracy of invoice processing while also ensuring businesses stay compliant with regulatory standards.

What is Invoice OCR Software?

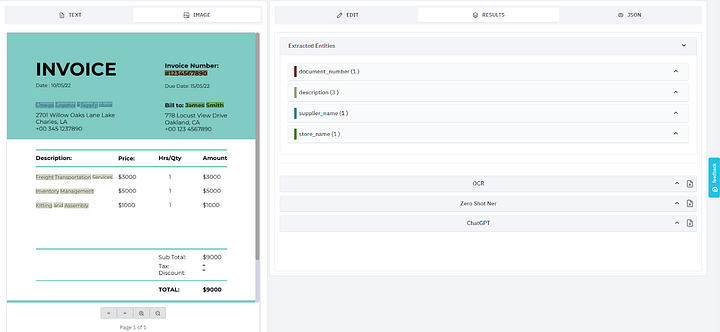

Invoice OCR software leverages Optical Character Recognition (OCR) technology to extract information from digital invoices, such as PDF files, and even scanned paper documents. This software uses advanced algorithms to convert images of text into structured data that can be easily integrated into accounting or Enterprise Resource Planning (ERP) systems.

- OCR tools can recognize and extract key details such as:

- Invoice numbers

- Vendor names and contact information

- Invoice dates and amounts

- Line items (description, quantity, and pricing)

By automating this process, OCR software eliminates manual data entry, which is prone to human error, and ensures that financial data is accurate and ready for further processing.

Importance of Data Accuracy in Invoice Processing

Inaccurate invoice data can have severe consequences, from delays in payments to errors in financial reporting, which can, in turn, affect compliance with regulatory standards. Manual data entry is labor-intensive and highly error-prone, leading to issues such as duplicated invoices, missing information, or incorrect amounts.

OCR software improves data accuracy by:

- Capturing data with near-perfect precision

- Eliminating the need for repetitive manual entry

- Reducing the time spent on auditing and correcting errors

With OCR, organizations can ensure that their financial data is accurate, complete, and reliable—key factors in maintaining trust with suppliers and regulatory bodies.

Key Functions of Invoice OCR Software

Invoice OCR software has several essential functions designed to enhance the accuracy and speed of invoice processing:

• Text Recognition: OCR identifies printed or handwritten text from scanned invoices and converts it into machine-readable characters.

• Field Matching: The software recognizes specific fields like invoice numbers, dates, and vendor information, placing them into a structured format.

• Data Validation: OCR systems cross-validate extracted data with existing records (e.g., purchase orders), ensuring accuracy before the information enters the system.

These functionalities not only improve the efficiency of invoice processing but also enhance the overall quality of the data being entered into financial systems.

How Invoice OCR Software Enhances Compliance

Compliance is a critical aspect of financial management, especially for businesses that handle large volumes of transactions. Invoices are subject to a variety of regulations, including tax codes, VAT requirements, and internal policies. Invoice OCR software ensures compliance by:

• Automating the extraction of VAT and tax-related information from invoices, reducing the likelihood of non-compliance.

• Creating a digital audit trail, makes it easier for auditors and regulatory bodies to verify transaction details.

• Ensuring consistency across invoices, regardless of the format in which they are received.

Furthermore, businesses must adhere to standards such as GDPR (General Data Protection Regulation) or SOC 2 Type II compliance for data security, especially when handling sensitive financial data. By automating invoice data extraction and storage, OCR solutions help companies ensure that all regulatory requirements are met with minimal manual intervention.

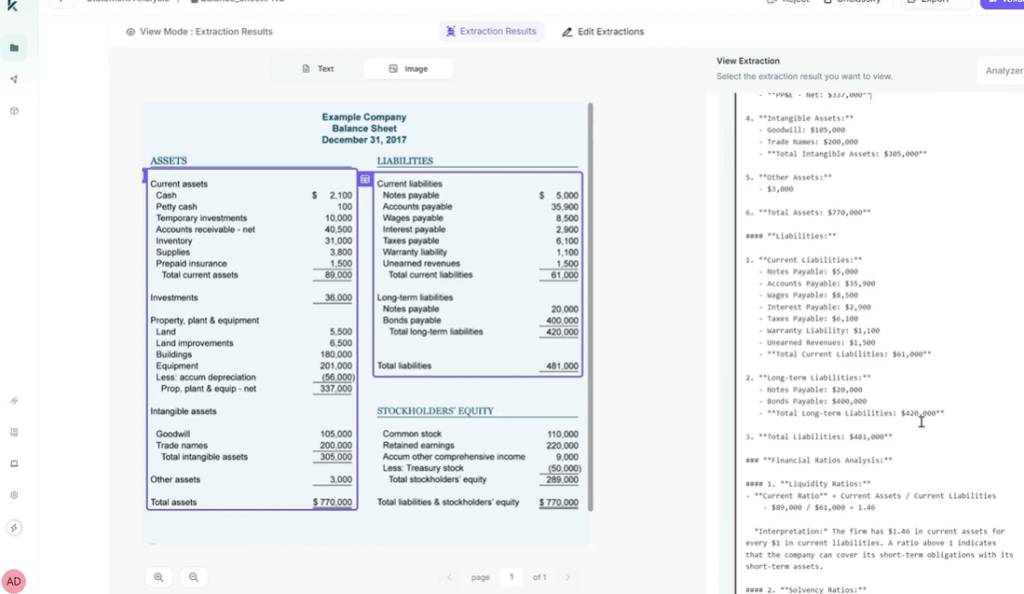

Enhancing Financial Reporting and Transparency

Accurate financial reporting is essential for effective decision-making. Errors in invoice processing can lead to discrepancies in financial statements, which can, in turn, affect business forecasting and compliance with legal requirements.

OCR systems provide real-time, accurate data that enhances financial reporting:

- Faster access to up-to-date invoice data

- Reduced risk of misreporting due to manual errors

- Better visibility into cash flow and outstanding payments

When financial data is consistently accurate, businesses can produce more reliable reports for audits, budgeting, and long-term strategic planning.

The Role of AI and Machine Learning in Enhancing Data Accuracy

As Artificial Intelligence (AI) and Machine Learning (ML) continue to advance, OCR software is becoming even more effective. AI-driven OCR tools learn from the data they process, improving their ability to recognize complex layouts and handwritten text. Machine learning models can be trained to identify patterns in invoices, increasing their accuracy over time.

These advancements help OCR software not only to extract data more accurately but also to adapt to different document formats and languages, further improving the quality of financial data.

Future Trends in Invoice OCR Software

Looking forward, innovations in Natural Language Processing (NLP) and cognitive data capture will further enhance the capabilities of OCR software. As more businesses adopt e-invoicing and automated workflows, the demand for OCR solutions that can handle diverse data formats will continue to grow.

Cloud-based OCR solutions and advanced analytics will also play a significant role in the future, providing businesses with real-time insights and better control over their financial operations.

These advancements help OCR software not only to extract data more accurately but also to adapt to different document formats and languages, further improving the quality of financial data.

The Essential Role of Invoice OCR Software

In conclusion, Invoice OCR Software is transforming the way businesses process invoices by enhancing data accuracy, improving compliance, and reducing operational costs. Its ability to automate tedious tasks while ensuring high levels of accuracy and regulatory adherence makes it an essential tool for modern businesses.

Adopting OCR technology today means laying a strong foundation for future growth, scalability, and compliance.

These advancements help OCR software not only to extract data more accurately but also to adapt to different document formats and languages, further improving the quality of financial data.