In today’s rapidly evolving business landscape, the ability to extract, analyze, and act on financial data swiftly and accurately is not just a competitive advantage but a necessity. Whether it’s closing monthly books, assessing financial health, or making strategic decisions, businesses are constantly faced with a flood of data that can either propel them forward or hold them back. As organizations grow and the volume of data increases, it becomes clear that traditional, manual methods of data extraction are no longer sufficient. The demand for real-time insights, coupled with the complexity of modern financial documents, has given rise to automated solutions that can keep pace with business needs. This is where intelligent data extraction, powered by advanced AI and machine learning technologies, comes into play.

In this post, we will explore the transformative impact of automated financial data extraction, delve into the limitations of traditional methods, and highlight the benefits that AI-powered solutions bring to the table. We’ll also introduce you to Kudra, an innovative AI platform that is at the forefront of intelligent document processing.

Challenges with Traditional Financial Data Extraction

For decades, financial teams have relied on manual methods of data extraction that, while functional, are increasingly inadequate in the face of today’s data demands. Below, we outline the primary challenges businesses face when using traditional methods of financial data extraction.

1. Time-Consuming Processes

Manually reviewing and extracting data from financial documents like invoices, balance sheets, and regulatory filings can take hours, if not days. Teams often spend significant time combing through documents, inputting data into spreadsheets, and cross-checking for accuracy. This process not only slows down decision-making but also limits the ability to respond swiftly to business challenges or opportunities.

2. Error-Prone Extraction

Human error is a critical concern in manual data extraction. Financial documents are complex, and even small mistakes—such as a misplaced decimal or an incorrect figure—can have serious repercussions for businesses. These errors often lead to costly revisions, financial misstatements, and compliance issues.

3. Limited Scalability

As businesses expand, so do their financial data needs. Manually scaling data extraction processes involves hiring additional staff or outsourcing work—both of which are costly and inefficient. In contrast, automated solutions can handle increasing volumes of data without the need for proportional staffing increases.

4. Inconsistent Data Quality

Manual extraction methods often result in inconsistencies in data quality. Different team members may interpret data differently, leading to a lack of uniformity in extracted information. This creates challenges in reporting, auditing, and compliance, where accuracy and consistency are paramount.

5. Slow Decision-Making

In a business environment where rapid decision-making is essential, manual data extraction falls short. The inability to provide real-time insights hinders an organization’s ability to respond to market changes, assess financial risks, and capitalize on new opportunities quickly.

6. Increased Compliance Risk

The financial sector is governed by stringent regulatory requirements, which demand precision and traceability in financial reporting. Manual processes, which are prone to errors and inconsistencies, increase the risk of non-compliance. Moreover, auditing manual processes are time-consuming and often results in delays and additional costs.

The Rise of AI-Powered Financial Data Extraction

Recognizing the limitations of manual methods, businesses across the globe are turning to AI-powered financial data extraction as a more efficient, accurate, and scalable solution. This shift has been facilitated by advancements in artificial intelligence (AI), machine learning (ML), and intelligent document processing (IDP).

AI-powered financial data extraction offers several advantages over traditional methods by automating the entire process—from document scanning to data extraction and analysis. But how exactly does this technology work?

1. Optical Character Recognition (OCR)

At the heart of AI-powered financial data extraction is OCR technology, which converts scanned documents, PDFs, and even images into machine-readable text. Modern OCR solutions, enhanced by AI, are far more sophisticated than their predecessors, enabling businesses to extract data from documents with complex layouts, handwritten notes, or multiple languages.

2. Artificial Intelligence and Machine Learning

AI algorithms go beyond simple text extraction by recognizing patterns and making intelligent decisions about the type of data to extract. Machine learning, on the other hand, ensures that these systems improve over time by learning from past extractions, becoming more accurate with every document processed.

3. Natural Language Processing (NLP)

NLP is another key component of intelligent data extraction. In the context of financial data, NLP helps systems understand and process unstructured text, such as contracts or emails, to identify relevant financial data buried within the narrative. This allows businesses to extract valuable insights from otherwise inaccessible information.

4. Intelligent Document Processing (IDP)

IDP platforms combine AI, OCR, NLP, and ML to automate the extraction, validation, and categorization of data from a wide range of financial documents. These systems are particularly adept at handling unstructured data, which is common in financial reports, invoices, and other business documents.

Benefits of AI-Powered Financial Data Extraction

The transition to AI-powered financial data extraction delivers a wide array of benefits that extend beyond simple efficiency gains. Here’s how it is transforming financial operations:

1. Speed and Efficiency

Automated systems can process vast amounts of financial data in a fraction of the time it would take human operators. This rapid extraction capability accelerates financial reporting, budgeting, and decision-making, providing businesses with the agility they need to stay ahead of the competition.

2. Increased Accuracy

By minimizing human intervention, AI-powered systems drastically reduce the likelihood of errors in data extraction. This is particularly important in financial operations, where accuracy is critical for maintaining compliance, ensuring accurate financial reporting, and avoiding costly mistakes.

3. Real-Time Insights

One of the most valuable benefits of intelligent data extraction is the ability to generate real-time insights. Finance teams no longer have to wait days or weeks for manual processes to catch up. Instead, they can access up-to-date financial information instantly, empowering them to make more informed decisions faster.

4. Enhanced Compliance

AI-powered systems offer robust compliance benefits by maintaining detailed audit trails, ensuring consistent data extraction, and minimizing errors that could lead to regulatory breaches. This is especially crucial in highly regulated industries like finance, where adherence to compliance standards is non-negotiable.

5. Cost Savings

By automating labor-intensive data extraction tasks, businesses can significantly reduce operational costs. The savings generated by minimizing manual labor, reducing errors, and avoiding compliance penalties can have a substantial impact on a company’s bottom line.

6. Scalability

AI-powered systems are highly scalable, allowing businesses to process increasing volumes of data without needing to hire additional staff. As organizations grow, these systems can handle larger workloads, making them a flexible solution for dynamic businesses.

7. Improved Data Quality

AI-driven systems ensure consistent data extraction, eliminating the inconsistencies that often occur with manual processes. They also provide automated validation and error-checking features, further enhancing the quality and reliability of financial data.

Kudra: Leading the Charge in Intelligent Data Extraction

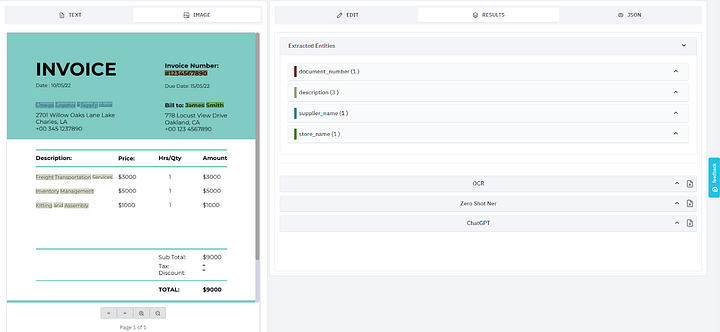

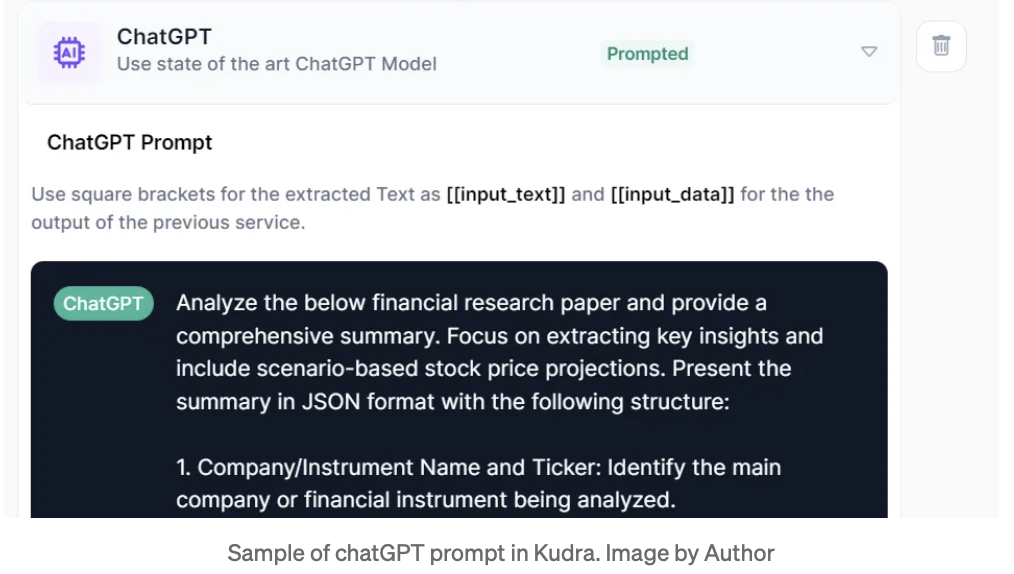

As businesses recognize the transformative potential of AI in financial operations, platforms like Kudra are emerging as leaders in the field of intelligent document processing. Kudra is designed to handle the complexities of financial data extraction with ease, offering a range of advanced features that cater to the specific needs of finance teams.

1. Versatile Document Processing

Kudra supports a wide range of document types, including invoices, receipts, contracts, financial statements, and regulatory filings. Its advanced OCR capabilities can handle even the most complex documents with precision.

2. Customizable Workflows

Kudra allows users to build customized extraction workflows that align with their specific business requirements. This flexibility ensures that the platform can adapt to different financial operations, whether it’s for budgeting, auditing, or regulatory compliance.

1. Versatile Document Processing

Kudra supports a wide range of document types, including invoices, receipts, contracts, financial statements, and regulatory filings. Its advanced OCR capabilities can handle even the most complex documents with precision.

3. AI-Driven Insights

Beyond simple data extraction, Kudra provides valuable insights by analyzing extracted data and highlighting key trends, potential errors, or discrepancies. This enables finance teams to not only extract information but also make informed decisions based on that data.

4. Seamless Integration

Kudra integrates seamlessly with existing enterprise systems, allowing businesses to streamline their document processing and financial workflows without needing to overhaul their infrastructure.

5. Scalability and Flexibility

Whether you’re processing a handful of documents or thousands, Kudra’s scalable architecture ensures that the system can grow with your business needs, handling larger volumes without sacrificing performance.

6. Enhanced Security

Kudra offers robust security features, including encrypted data processing and strict access controls, ensuring that sensitive financial information remains protected throughout the extraction process.

For a more detailed process, you can check our guide: 5 Steps to Automate Financial Data Extraction with Kudra

Conclusion

Intelligent data extraction is no longer a luxury but a critical component of modern financial decision-making. As businesses continue to grapple with the growing complexity and volume of financial data, platforms like Kudra are stepping in to provide efficient, accurate, and scalable solutions. By embracing AI-powered data extraction, businesses can accelerate their financial decision-making processes, ensure compliance, and gain a competitive edge in the marketplace. For further details about IDP in the finance industry, check our Guide to Financial Data Extraction & Automation